What are the Global Market Trends for Mold Upenders from 2023 to 2030?

Handling large, heavy molds presents significant safety risks and operational inefficiencies. Manually turning or positioning these molds is time-consuming and dangerous. Mold upenders offer a safe, efficient solution, but understanding market dynamics is crucial for investment and strategic planning. What does the future hold for this essential equipment?

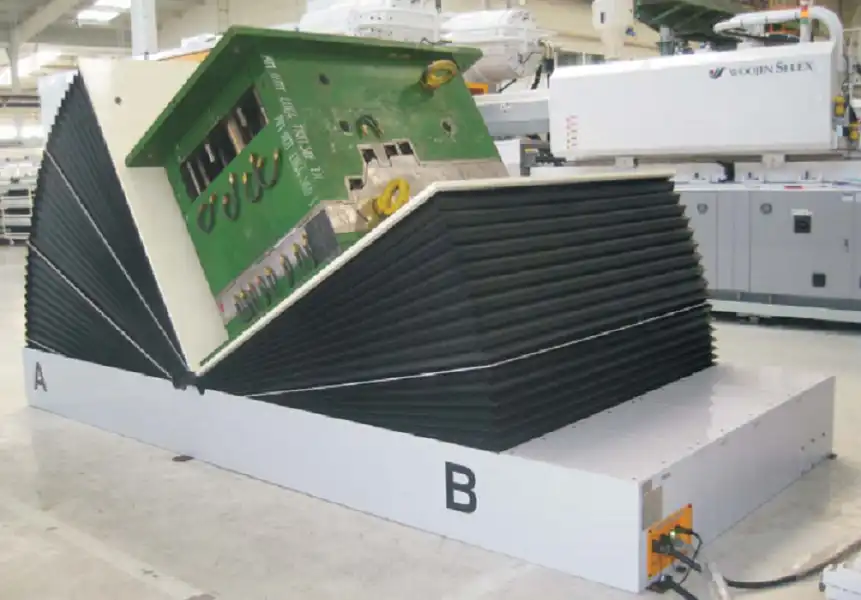

The global mold upender market is projected to experience steady growth from 2023 to 2030, driven primarily by the expansion of manufacturing sectors, particularly automotive and packaging, increased focus on workplace safety regulations, and the rising adoption of automation in industrial processes. Key trends include demand for higher capacity units, integration with smart factory systems, and enhanced safety features, mirroring growth patterns seen in the broader industrial mold market.

Understanding these trends is vital for manufacturers, suppliers, and end-users to navigate the evolving landscape. This analysis delves into the key drivers, regional dynamics, technological advancements, and potential challenges shaping the mold upender market through 2030, providing insights for informed decision-making in this critical industrial segment.

Key Market Drivers Fueling Mold Upender Demand

The growing necessity for enhanced efficiency and safety in industrial mold handling is significantly propelling the demand for mold upenders. As industries like automotive, manufacturing, and packaging expand globally, the frequency of mold changes and maintenance increases, making safe and rapid repositioning essential. This surge directly fuels the adoption rate of specialized equipment like mold upenders, moving away from riskier traditional methods.

Key drivers for the mold upender market include the robust expansion of global manufacturing and production sectors, particularly in automotive and consumer goods, demanding frequent mold handling. Increased emphasis on stringent workplace safety standards globally mandates safer alternatives to manual mold tilting. Furthermore, the drive for operational efficiency and reduced downtime in high-volume production environments, coupled with the integration of automation and Industry 4.0 principles, necessitates advanced handling solutions like mold upenders. The rising complexity and size of molds also contribute significantly.

Deep Dive into Growth Accelerators

The trajectory of the mold upender market is closely tied to several fundamental industrial trends. Analyzing these drivers provides a clearer picture of the forces shaping demand.

Expanding Manufacturing Sector

The overall health of the global manufacturing sector is a primary indicator for mold upender demand. As production volumes increase across various industries, the need for molds and consequently, the equipment to handle them, grows proportionally. The source material highlights significant growth, citing, for instance, UK manufacturers achieving product sales of approximately $579.5 billion in 2022, a 7% rise from 2021. This expansion, mirrored in many industrializing and established economies, translates directly into increased activities involving mold installation, removal, maintenance, and storage – all processes where upenders enhance safety and efficiency. Industries relying heavily on molding, such as consumer electronics, medical devices, and packaging, contribute significantly to this demand as they scale up production.

Automotive Industry Dynamics

The automotive industry is a major consumer of large and complex molds for components ranging from body panels and interior parts to engine components. The source material notes that developments in the automotive industry accelerate the growth of the industrial mold market. Constant model updates, lightweighting initiatives requiring new material processing molds (plastics, composites, light alloys), and high production volumes necessitate frequent mold changes and maintenance. Mold upenders are crucial for safely and efficiently handling these often heavy and unwieldy automotive molds, reducing changeover times and minimizing the risk of damage to expensive tooling or injury to personnel. The shift towards electric vehicles (EVs) also introduces new components and designs, further stimulating demand for new molds and associated handling equipment.

Emphasis on Safety and Efficiency

Workplace safety regulations are becoming increasingly stringent worldwide. Manual handling of heavy molds poses significant risks of crush injuries, strains, and other accidents. Mold upenders provide a mechanically controlled method for tilting and rotating molds, drastically reducing manual effort and associated risks. This aligns with the industry’s drive towards lower labor costs mentioned in the source material, not by eliminating jobs, but by making processes safer and enabling workers to perform tasks more efficiently. Reducing downtime during mold changes or maintenance is critical for profitability. Upenders significantly speed up the process compared to using overhead cranes and manual rigging, contributing directly to operational efficiency and supporting mass production capabilities.

Technological Integration (Industry 4.0)

The push towards smart factories and Industry 4.0 principles influences the design and demand for mold upenders. Modern upenders are increasingly equipped with automation features, such as PLC controls, remote operation, and integration capabilities with factory management systems (MES/ERP). This allows for better process control, data logging, and coordination within automated production cells. As manufacturers invest in advanced machinery like the five-axis centers mentioned from DMG MORI, the demand for equally sophisticated and integrated handling equipment, including mold upenders, rises to maintain seamless workflow automation.

| Feature | Manual Handling (Crane/Forklift & Rigging) | Mold Upender Handling | Impact |

|---|---|---|---|

| Time | High | Low | Reduced Downtime |

| Safety Risk | High (Crushing, Dropping, Strain) | Low | Improved Worker Safety |

| Labor Cost | Moderate-High (Requires skilled riggers) | Low-Moderate | Efficiency, Skill Focus Shift |

| Mold Damage Risk | Moderate | Low | Protects Investment |

| Control | Limited Precision | High Precision | Accurate Positioning |

These drivers collectively create a compelling case for the adoption and upgrading of mold upender technology across industries reliant on molding processes.

Regional Market Analysis and Opportunities

The global distribution of mold upender demand mirrors the concentration of industrial manufacturing activity. Understanding the regional nuances is key to identifying growth hotspots and market potential through 2030. North America and Asia-Pacific stand out as dominant regions, driven by their extensive manufacturing bases.

North America currently leads the mold upender market, leveraging its established automotive, aerospace, and consumer goods industries, coupled with high adoption rates of automation and safety standards. Asia-Pacific follows closely, projected to exhibit the fastest growth due to rapid industrialization, expanding manufacturing hubs in China, India, and Southeast Asia, and increasing investments in advanced production technologies. Europe remains a significant market, while LAMEA shows emerging potential.

Mapping Growth Hotspots

While the demand for mold upenders is global, specific regions exhibit distinct characteristics and growth potentials:

-

North America: This region benefits from a large, established industrial base, particularly in the automotive, aerospace, and packaging sectors. High labor costs and stringent safety regulations (e.g., OSHA standards in the U.S.) strongly incentivize the adoption of automated handling solutions like mold upenders. While the source material indicates North America held 35% of the general industrial mold market in 2018, this strong presence implies a correspondingly mature market for mold handling equipment. Future growth is likely driven by upgrades to more automated and higher-capacity systems, and reshoring initiatives boosting domestic manufacturing. Key players in mold making and end-use industries are concentrated here, ensuring sustained demand.

-

Asia-Pacific: Identified as the second-largest region for the general mold market (30% share in 2018) and anticipated to be the fastest-growing market for mold upenders. This growth is fueled by the region’s status as a global manufacturing powerhouse. Countries like China, Japan, South Korea, and increasingly India and Southeast Asian nations, have massive automotive, electronics, and consumer goods production facilities. Rapid industrial expansion, rising investments in manufacturing infrastructure, and a gradual increase in automation adoption to improve quality and efficiency drive demand. While initial adoption might favor basic models due to cost sensitivity in some areas, the trend towards higher quality and safety standards will boost demand for more advanced upenders.

-

Europe: Home to a sophisticated industrial landscape, especially in Germany, Italy, and France, with strong automotive, machinery, and plastics processing sectors. Similar to North America, Europe has stringent safety standards (e.g., CE marking requirements) and a high degree of automation. The demand here is characterized by a need for high-precision, reliable, and often customized mold handling solutions integrated into advanced production lines. The push for Industry 4.0 and sustainable manufacturing practices further supports investment in modern, efficient equipment like energy-saving upenders.

-

Latin America, Middle East & Africa (LAMEA): These regions represent smaller but potentially growing markets. Industrial development, particularly in automotive assembly (Mexico, Brazil) and resource-based manufacturing (Middle East), creates opportunities. However, market penetration may be slower compared to major regions due to factors like economic volatility, varying levels of industrial maturity, and potentially lower initial investment capacity for specialized equipment. Growth is often project-driven and linked to foreign direct investment in manufacturing facilities.

Overall, the global landscape suggests sustained demand in established markets driven by replacement cycles, technological upgrades, and safety mandates, while emerging economies in Asia-Pacific offer the most significant volume growth potential as their manufacturing sectors continue to expand and modernize.

Technological Advancements and Future Trends

Sticking with outdated mold handling methods invites inefficiency and safety hazards. As molds become larger and more complex, and production demands faster cycles, basic equipment struggles to keep pace. The solution lies in adopting the next generation of mold upender technology, integrating innovation for optimal performance.

Future trends in mold upenders focus heavily on automation, connectivity, and enhanced safety. Expect increased integration with automated guided vehicles (AGVs) and central factory control systems (Industry 4.0). Innovations will include smarter sensors for load balancing and preventive maintenance alerts, greater customization options for specific mold geometries and cleanroom environments, and potentially the use of lighter, stronger materials in upender construction for improved energy efficiency.

Innovations Shaping the Mold Upender Landscape

The evolution of mold upenders is driven by the broader trends in manufacturing technology, aiming for greater efficiency, safety, integration, and customization.

Automation and Integration

The move towards fully automated production lines necessitates mold handling equipment that can seamlessly integrate. This means:

- PLC Control: Advanced Programmable Logic Controllers allow for precise, repeatable operation sequences and easy adjustment of parameters like rotation speed and angle.

- Remote Operation: Control pendants or remote stations allow operators to manage the upender from a safe distance, improving visibility and safety.

- System Integration: Connectivity via industrial Ethernet protocols (like Profinet, EtherNet/IP) enables communication with MES, ERP, or robotic cells. This allows the upender’s status to be monitored centrally and its operation to be coordinated with other equipment, such as overhead cranes or AGVs delivering molds. Automated sequences for loading, tilting, and unloading can be programmed, reducing manual intervention.

Enhanced Safety Features

Safety remains paramount. Innovations go beyond basic mechanical stops:

- Sensors: Load sensors can verify the mold weight is within capacity and ensure proper centering to prevent imbalances. Presence sensors can detect obstructions or personnel in the operating area, triggering emergency stops.

- Interlocks: Safety interlocks prevent operation if guards are open or if the mold is not securely clamped (where applicable). Electrical and hydraulic systems incorporate redundant safety features.

- Visual and Audible Alarms: Clear signaling alerts personnel to the upender’s operational status and potential hazards.

- Controlled Motion: Soft start/stop features and variable speed control ensure smooth, jolt-free rotation, protecting the mold and the equipment itself.

Customization and Capacity

As molds vary greatly in size, weight, and configuration (e.g., molds with complex cooling channels from 3D printing, multi-cavity molds), the demand for customized upenders grows.

- Higher Load Capacities: Trends towards larger parts (e.g., automotive bumpers, large appliance housings) necessitate upenders capable of handling molds weighing many tons.

- Tailored Platforms: Platform sizes, shapes (e.g., V-saddles for cylindrical objects), and surface materials can be adapted to specific mold types.

- Special Environments: Upenders designed for cleanroom environments (e.g., medical or electronics manufacturing) may use stainless steel construction and specialized drives.

- Flexibility: Designs accommodating a wider range of mold dimensions improve versatility for job shops or manufacturers with diverse product lines.

Sustainability Considerations

While not always a primary driver, efficiency and longevity contribute to sustainability:

- Energy Efficiency: Utilizing energy-efficient motors and hydraulic systems can reduce operational costs and environmental impact.

- Durability: Robust construction using high-quality materials ensures a long service life, reducing the need for premature replacement and associated resource consumption.

| Feature | Basic Mold Upender | Advanced Mold Upender | Benefit of Advancement |

|---|---|---|---|

| Control | Manual Push-button | PLC, Remote, System Integration | Automation, Efficiency, Data Logging |

| Safety | Mechanical Stops, E-Stop | Sensors, Interlocks, Alarms, VSC | Proactive Hazard Prevention, Control |

| Integration | Standalone | Network Capable (Ethernet/IP etc.) | Smart Factory Compatibility |

| Customization | Standard Sizes/Capacities | Tailored Platform, High Capacity | Handles Diverse/Large Molds |

| Maintenance | Reactive | Potential for Predictive Sensors | Reduced Unplanned Downtime |

These advancements ensure that mold upenders remain a critical enabling technology, adapting to the evolving needs of modern manufacturing.

Challenges and Market Restraints

While the outlook for mold upenders is generally positive, certain factors can impede market growth or pose challenges for manufacturers and adopters. Understanding these restraints is crucial for realistic market assessment and strategic planning.

Key challenges facing the mold upender market include the significant initial investment cost, which can be a barrier, especially for small and medium-sized enterprises (SMEs). The need for trained personnel for operation and maintenance, coupled with potential shortages of skilled labor in some regions, presents another hurdle. Competition from alternative, albeit often less safe or efficient, handling methods like overhead cranes and forklifts persists. Furthermore, economic downturns can lead to deferred capital expenditure on auxiliary equipment.

Elaborating on these points:

-

High Initial Cost: Mold upenders represent a significant capital investment. As highlighted in the source material regarding the general mold market, high initial costs associated with tools and equipment can negatively impact growth. This applies directly to upenders, particularly advanced models with high capacity or automation features. SMEs with limited budgets may struggle to justify the upfront expense compared to using existing, multi-purpose equipment like cranes, even if the long-term safety and efficiency benefits are substantial. Financing options and demonstrating clear ROI become critical for suppliers.

-

Skilled Labor Requirements: Operating and maintaining industrial machinery, including mold upenders, requires training. While designed for ease of use, proper operation procedures are essential for safety. Maintenance, especially for hydraulic and electrical systems, requires skilled technicians. The source material indirectly touches upon labor issues, and finding and retaining qualified personnel can be challenging in some manufacturing hubs, potentially impacting the adoption or effective utilization of such equipment.

-

Competition from Alternatives: While mold upenders offer specific advantages for tilting operations, factories often already possess overhead cranes and heavy-duty forklifts. For infrequent mold handling tasks or in facilities with space constraints, companies might opt to continue using these existing assets with specialized rigging, despite the higher risks and potential inefficiencies. Overcoming this inertia requires clearly demonstrating the superior safety, speed, and mold protection offered by dedicated upenders.

-

Economic Volatility: Manufacturing investments are sensitive to economic cycles. During downturns or periods of uncertainty (like the COVID-19 impact described in the source material), companies often postpone investments in capital equipment, prioritizing essential production machinery over auxiliary systems like mold upenders. Geopolitical tensions and supply chain disruptions can also impact both the availability and cost of equipment and the willingness of end-users to invest.

Navigating these challenges requires strategies such as offering modular or scalable solutions, providing robust training and support, clearly articulating the value proposition (safety ROI, efficiency gains), and potentially exploring leasing or financing models to ease the initial cost burden for customers.

Conclusion

The global market for mold upenders is set for consistent growth from 2023 to 2030, intrinsically linked to the expansion and modernization of the manufacturing sector worldwide. Key drivers include the relentless pursuit of operational efficiency, increasingly stringent workplace safety standards, the rise of automation within Industry 4.0 frameworks, and the growing complexity and size of molds used across automotive, packaging, medical, and other industries. Technological advancements focusing on integration, enhanced safety features, and customization will further shape the market. While challenges like initial cost and economic volatility exist, the fundamental benefits offered by mold upenders in protecting personnel and valuable tooling position them as essential equipment. Ongoing Upender market analysis confirms a positive trajectory, indicating continued adoption and innovation in this vital industrial segment.