An Executive Report on Multilevel Coil Storage Systems: A Strategic Analysis of Solutions, Compliance, and Financial Viability

Executive Summary

Purpose and Scope

This report provides a comprehensive decision-making framework for industrial leaders evaluating investments in multilevel coil storage systems. It addresses the critical challenges inherent in traditional coil storage—such as floor stacking—and presents a detailed analysis of modern solutions, from basic static racking to fully integrated Automated Storage and Retrieval Systems (AS/RS). The scope encompasses a technical comparison of system architectures, a thorough examination of regulatory and safety compliance, and a robust financial analysis of costs, Total Cost of Ownership (TCO), and Return on Investment (ROI). The objective is to equip operations directors, plant managers, and capital project managers with the data and analysis necessary to select, justify, and implement the optimal coil storage solution for their specific operational context.

Key Findings

The analysis has yielded several critical findings that should guide any investment decision in this area:

- Fundamental Trade-Offs: A clear and unavoidable trade-off exists between storage density, inventory selectivity, and capital cost. High-density systems like double-deep or automated solutions maximize space but may limit direct access to every coil, whereas selective racking offers 100% access at the cost of a larger footprint.1

- The Primacy of Structural Engineering: For heavy coil applications, particularly in seismically active regions like California, the choice between lower-cost roll-formed steel and heavy-duty structural I-beam racking is a pivotal strategic decision. The superior durability, impact resistance, and load capacity of structural steel often result in a lower Total Cost of Ownership, despite a higher initial investment, by mitigating risks of damage, downtime, and non-compliance with stringent building codes.2

- The Transformative Potential of Automation: Automated Storage and Retrieval Systems (AS/RS) represent the apex of coil storage technology, capable of handling massive loads up to 75,000-80,000 lbs.2 These systems deliver transformative ROI by drastically increasing storage density, maximizing throughput, reducing labor requirements, and virtually eliminating product damage. The investment is substantial, often exceeding $1 million, but the operational gains can be equally significant.3

- Financial Viability and ROI: The financial case for advanced storage systems is compelling. While initial costs range from a few thousand dollars for basic floor components to several million for a full AS/RS, the ROI is driven by the reduction of hidden costs associated with inefficient, unsafe storage. Case studies and financial models demonstrate that payback periods for automation can be as short as 6 to 18 months, with TCO analyses showing modern systems can save hundreds of thousands to millions of dollars over their operational life compared to outdated methods.4

Strategic Recommendations

The selection of a multilevel coil storage system should not be viewed as a simple equipment purchase but as a strategic investment in operational efficiency, safety, and capacity. It is recommended that decision-makers adopt a phased, data-driven approach. The first step should be a thorough audit of the current operation’s "hidden costs"—wasted floor space, inventory damage rates, labor inefficiencies, and safety liabilities. This baseline data is crucial for building a powerful business case. The final selection should be guided by a clear understanding of the facility’s specific operational profile, including throughput requirements, inventory mix, and long-term growth strategy, using the analytical frameworks provided in this report.

The Strategic Imperative for Advanced Coil Storage

The method by which a facility stores its metal coils is a foundational element of its operational and financial health. Traditional methods, often born of necessity rather than design, carry significant and often underestimated costs that directly impact safety, productivity, and profitability. Transitioning to a dedicated, engineered multilevel storage system is a strategic decision that addresses these inherent flaws and unlocks substantial value.

The Inherent Risks and Inefficiencies of Traditional Methods

For decades, the default method for storing heavy coils has been to place them directly on the warehouse floor, sometimes stacked in pyramids or chocked with simple wood blocks.4 While seemingly simple, this approach creates a cascade of inefficiencies and risks.

- Space Inefficiency: Floor storage is the least efficient use of warehouse space. By failing to utilize the vertical cube of the building, it consumes vast amounts of valuable floor area that could otherwise be allocated to revenue-generating activities like manufacturing or assembly.2 This spatial inefficiency can force companies into premature and costly facility expansions.5

- Product Damage: Coils are high-value assets that are exceptionally vulnerable when stored improperly. Contact with concrete floors can lead to moisture absorption and corrosion. The immense weight in a pyramid stack can cause creasing, flattening, and edge damage to the coils at the bottom.2 Furthermore, the constant need to move coils to access others increases the likelihood of impact damage. This material degradation translates directly to reduced yield and lost revenue.6

- Operational Inefficiency: The lack of direct access to every coil is a primary source of operational waste. To retrieve a specific coil buried in a stack, operators must first move several other multi-ton coils out of the way. This process, often called "honeycombing," is a non-value-added activity that consumes significant time, labor, and equipment hours, creating a major bottleneck in the workflow from inventory to production.7

- Safety Hazards: Unsecured, floor-stacked coils represent one of the most significant safety hazards in an industrial environment. Their cylindrical shape makes them inherently unstable and prone to rolling or tipping, especially if the floor is uneven or if they are bumped by handling equipment.2 A rolling multi-ton coil can cause catastrophic damage to equipment and infrastructure and poses a lethal threat to personnel. This liability is a central concern of regulatory bodies like the Occupational Safety and Health Administration (OSHA).8

Core Benefits of Dedicated Multilevel Storage Systems

Investing in an engineered multilevel coil storage system is the definitive solution to the problems of traditional methods. The benefits extend beyond simple organization and touch every aspect of the operation.

- Optimized Space Utilization: The most immediate benefit is the conversion of unused vertical air space into productive storage capacity. By stacking coils safely on multiple levels, facilities can dramatically increase their storage density, often doubling or tripling the amount of material stored within the same footprint.9 This frees up valuable floor space, enhances workflow, and can postpone or eliminate the need for a capital-intensive building expansion.

- Enhanced Safety and Security: Engineered racking systems are designed and constructed specifically to provide stable, secure support for heavy, cylindrical loads. Features like custom-fit cradles, roll stops, and robust structural frames prevent coils from shifting or rolling, drastically reducing the risk of accidents.2 This proactive approach to safety not only protects employees but also ensures compliance with OSHA’s mandate for the secure storage of tiered materials.10

- Improved Inventory Management and Selectivity: A structured racking system allows each coil to be assigned a specific, designated location. This facilitates precise inventory tracking and management.11 Systems like selective racking provide 100% selectivity, meaning any coil can be accessed directly without moving others. This is critical for operations with a high mix of products and enables efficient inventory rotation strategies like "first-in, first-out" (FIFO) to prevent material aging.11

- Increased Productivity and Throughput: The combination of improved organization and direct accessibility dramatically reduces the time required to retrieve a specific coil. What previously took extensive maneuvering of multiple coils can be reduced to a single, efficient lift. This minimizes downtime for production lines waiting on material and accelerates the shipping process, directly boosting overall plant productivity and throughput.6

The logical progression is clear: the hidden costs of floor storage—wasted space, damaged inventory, inefficient labor, and safety liabilities—are not just operational annoyances; they are quantifiable financial drains. A multilevel racking system is engineered to directly counteract each of these drains. Therefore, the financial justification for such an investment should not be measured against its purchase price alone, but against the substantial and continuous costs it eliminates. A comprehensive audit of the current costs associated with floor storage provides a powerful and compelling baseline for calculating the return on this strategic investment.

Manual and Semi-Automated Racking Solutions

For facilities transitioning from floor storage or upgrading existing systems, a wide array of manual and semi-automated racking solutions offer a spectrum of capabilities balancing density, selectivity, and cost. The selection process requires a careful analysis of the specific coil types, handling processes, and structural requirements of the operation.

Comparative Analysis of Racking System Architectures

The architecture of a coil racking system dictates its fundamental performance characteristics. Each design offers a unique combination of benefits and trade-offs tailored to different operational needs.

- Standard Coil Storage Racks: Often adapted from conventional selective pallet racking, these systems consist of vertical upright frames connected by horizontal load beams.11 To accommodate coils, the beams are fitted with specialized cradles or supports. Their primary advantage is 100% selectivity, allowing direct and immediate access to every coil stored. This makes them ideal for operations with a high number of different stock-keeping units (SKUs) but a relatively low volume of each.1 However, this high selectivity comes at the cost of lower storage density, as a separate aisle is required for each row of racks.

- Coil Cradles and Modular Systems: These systems focus on providing tailored support for individual coils.

- Steel Cradles: These are V-shaped or curved supports, typically constructed from steel angles or round tubes, that are mounted onto the rack beams.9 They are designed to support the coil at its core or along its circumference, preventing the coil from rolling and minimizing the risk of deformation.2 Many systems, like those from Dexco, feature full-depth cradles that can handle a wide range of coil sizes and weights, with adjustability to accommodate changing inventory needs.2

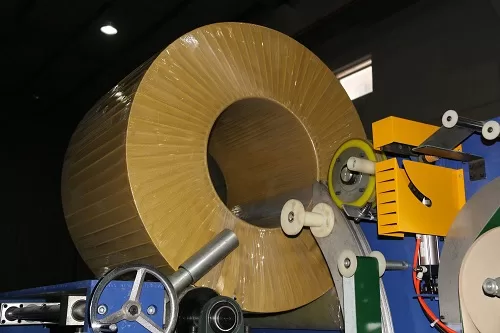

- Polymeric Systems: An innovative alternative to steel, these systems use components made from high-strength, ductile recycled plastics.12 Lankhorst Mouldings’ KLP® line, for example, includes modular components like the RollStop System, which uses rails and individual stops to secure coils up to three levels high, and the CoilWedge System, which uses long wedged beams suitable for both wide and narrow slit coils up to two levels high.12 These systems are prized for their flexibility, ease of installation (often without bolting to the floor), and their non-damaging contact surfaces. Specialized versions are available for high-temperature coils (up to 110°C) and for outdoor use with corrosion-resistant components.12

- Slit Coil Racks: Storing slit coils—narrow strips cut from a master coil—presents a unique stability challenge. Standard coil cradles are often dangerously inadequate. Specialized slit coil racks feature dividers or deep compartments that provide lateral support to prevent the tall, narrow coils from tipping over.11 It is a critical safety point that slit coils should not be stored in standard coil racks unless explicitly engineered for that purpose. Safe alternatives include storing them "eye to the sky" on pallets within a pallet rack or using dedicated, often floor-mounted, slit coil storage units.13

- Vertical Coil Racks: These systems store coils in a vertical, or "eye to the sky," orientation.11 This approach is highly effective for maximizing the use of vertical warehouse height and is particularly well-suited for storing long or narrow coils that would be unstable or awkward to store horizontally.

- High-Density Racking: For operations prioritizing storage capacity over individual access, high-density designs are employed.

- Double-Deep Coil Racks: This configuration places one row of racking directly behind another, allowing coils to be stored two-deep from the aisle.9 This can nearly double the storage capacity of a given area compared to selective rack, but it reduces selectivity to 50% (the front coil must be moved to access the back coil) and requires the use of specialized deep-reach forklifts.14 These systems are robustly designed, often with four beams per level (one front, two interior, one back) to support the heavy loads.9

The following table provides a comparative overview of these manual and semi-automated systems.

| System Type | Storage Density | Selectivity | Typical Max Capacity (per position) | Key Advantages | Key Disadvantages/Risks | Ideal Application |

|---|---|---|---|---|---|---|

| Standard Coil Rack | Low to Medium | 100% | 6,000 – 20,000 lbs 9 | Direct access to every coil; simple design; versatile. | Requires significant aisle space; lower density. | High SKU count, low volume per SKU; frequent access needed. |

| KLP® Polymeric System | Medium | 100% | Up to 100 tons (4 RollStops) 12 | Protects coil surface; flexible/modular; easy install; heat/weather resistant options. | Higher initial cost than wood; relies on interlocking components for stability. | Storing sensitive, painted, or high-value coils; flexible layouts. |

| Slit Coil Rack | High | 100% (within compartment) | Varies by design | Safely contains unstable narrow coils; organizes small inventory. | Not suitable for master coils; requires specific handling. | Metal service centers and fabricators handling narrow slit coils. |

| Vertical Coil Rack | High | 100% | Varies by design | Maximizes vertical height; ideal for narrow/long coils. | Requires specialized handling to orient coils; may be less stable. | Warehouses with high ceilings and narrow coil inventory. |

| Double-Deep Rack | High | 50% | 6,000 – 12,000 lbs 9 | Increases storage capacity significantly over selective rack. | Requires special reach trucks; LIFO inventory rotation; reduced access. | Low SKU count, high volume per SKU; long-term storage. |

| Cantilever Rack | Medium | 100% | Up to 20,000 lbs per arm 15 | Unobstructed frontal access; ideal for varied coil widths; highly adjustable. | Arm tips are vulnerable to impact; requires careful load placement. | Storing coils of varying widths, long products, and other bulky items. |

Structural Integrity and Material Science: The Critical Choice

The long-term safety, durability, and cost-effectiveness of a racking system are determined by its material and construction method. The two primary options present a classic trade-off between initial cost and lifecycle value.

- Roll-Formed Steel Racking: This is the most common type of industrial racking. Components are manufactured by passing coiled sheet steel through a series of rollers that progressively bend it into the desired shape, such as an upright column with a "teardrop" hole pattern for connecting beams.9

- Advantages: The primary advantage is a lower initial purchase price and typically simpler, faster installation.9

- Disadvantages: Roll-formed steel is more susceptible to damage from forklift impacts. A dent or deformation in a roll-formed upright can significantly compromise its structural integrity and load-bearing capacity. While it can be engineered to handle heavy loads, it may require heavier gauges and more reinforcement compared to structural steel, eroding some of the cost advantage. An example specification for a roll-formed upright might be a 12-foot high, 14-gauge steel column with a capacity of 23,600 lbs at a 48-inch beam spacing.9

- Structural Steel I-Beam Racking: This heavy-duty option utilizes components made from hot-rolled structural steel shapes, such as I-beams and C-channels, the same materials used to construct bridges and buildings.2 Components are typically connected with high-strength structural bolts.

- Advantages: The inherent thickness and strength of structural steel provide superior durability and a much higher resistance to impact damage from handling equipment.9 This robustness makes it the preferred choice for storing extremely heavy coils, with some systems engineered to handle loads of 80,000 lbs per tier or even more.2 Its strength also makes it better suited for engineering to meet stringent seismic codes.

- Disadvantages: Structural racking has a significantly higher initial capital cost and a more labor-intensive, bolted assembly process.9

The decision between these two materials is not merely a matter of budget. It is a strategic assessment of risk and long-term cost. In a high-traffic warehouse environment where forklift impacts are a statistical certainty 16, the greater durability of structural steel can lead to a lower total cost of ownership by reducing repair costs, replacement expenses, and operational downtime. For facilities located in seismic zones like California, or for any application involving very heavy coils, the superior strength and predictable engineering performance of structural steel make it the far safer and often more logical choice.17 High-quality systems are engineered to meet the rigorous standards of the American Institute of Steel Construction (AISC) and utilize high-strength steel with a minimum yield of 50 KSI and ASTM A325 structural bolts.2

Cantilever Racking: A Specialized Application for Coils

While most coil racking is a variation of pallet rack, cantilever racking offers a distinct architecture that is uniquely suited for certain coil storage applications.

- Design Principles: The defining feature of a cantilever rack is the absence of a front vertical column. The system is built around a central column (or "tower") with a series of arms extending horizontally from one or both sides.18 This design creates an open and unobstructed storage level, ideal for loading and unloading long, bulky, or irregularly shaped items—including metal coils—without the interference of a front upright.18

- Configuration Options: Cantilever racks are highly versatile. They can be configured as single-sided units placed against a wall or as double-sided units to create back-to-back storage aisles.19 For outdoor applications, they can be manufactured with a hot-dip galvanized finish for corrosion protection and can be fitted with integrated roof trusses to shield inventory from the elements.19

- Key Components:

- Columns and Bases: The vertical columns, often made from hot-rolled IPE steel profiles, are the system’s backbone and are bolted to a heavy base that provides stability.18

- Arms: The load-bearing arms are the horizontal members that support the coils. They are typically adjustable vertically in increments of 3 or 4 inches to accommodate loads of different heights.15 Arms can be straight or inclined at a slight upward angle to prevent round items from rolling off. They can also be fitted with "lips" or end-stops for added security.20

- Bracing: Rows of cantilever towers are connected by horizontal and diagonal cross-bracing to ensure lateral stability and rigidity along the length of the system.20

- Safety Considerations: The open-front design, while a key advantage for access, also presents a specific risk: the exposed arm tips are vulnerable to impact from forklifts and loads during handling.21 Operators must be trained to load and unload with care. Additionally, because coils can be long and flexible, load deflection or sagging must be managed by ensuring the arms are spaced correctly to provide adequate support along the coil’s length.22

Fully Automated Coil Storage & Retrieval Systems (AS/RS)

For high-volume, high-throughput operations, the transition from manual or semi-automated racking to a fully Automated Storage and Retrieval System (AS/RS) represents a quantum leap in efficiency, density, and safety. These systems are not merely an evolution of racking but a fundamentally different, integrated infrastructure project that redefines the role of the warehouse.

The Leap to Automation: Principles and Advantages

At its core, an AS/RS is a combination of high-density racking, computer-controlled machinery, and intelligent software designed to automate the storage and retrieval of goods with minimal human intervention.23 Instead of wide aisles for forklifts, an AS/RS uses one or more stacker cranes or robotic shuttles that operate in very narrow aisles, dramatically increasing storage capacity within a given building footprint.

The benefits of this technological shift are transformative:

- Maximum Storage Density: By minimizing aisle widths and maximizing the use of vertical space—with some systems reaching heights of 45 meters (147 feet)—an AS/RS can increase warehouse storage capacity by 40% or more compared to conventional racking systems. This allows businesses to store significantly more inventory in their existing facility, often eliminating the need for costly expansions or off-site storage.6

- Unmatched Throughput and 24/7 Operation: AS/RS are engineered for continuous, high-speed operation. Stacker cranes can achieve travel speeds up to 240 m/min (787 ft/min) and high rates of acceleration, drastically reducing the cycle times for storing and retrieving coils.24 This allows the warehouse to keep pace with the fastest production lines and shipping schedules, operating around the clock without breaks or shift changes.6

- Labor Reduction and Enhanced Safety: AS/RS virtually eliminates the need for manual labor within the storage area. This yields significant savings in labor costs and reallocates human capital to more value-added tasks.25 More importantly, it removes employees from the hazardous environment of handling multi-ton coils, leading to a profound improvement in workplace safety and a reduction in accidents and injuries.24

- Inventory Accuracy and Damage Reduction: Every movement in an AS/RS is controlled by a computer, ensuring that coils are handled with precision and gentleness that is impossible to replicate manually. Laser-guided positioning and specialized grippers minimize the risk of product damage during handling.24 Simultaneously, the system’s software maintains a perfect, real-time record of every coil’s location and status, achieving near-100% inventory accuracy and eliminating picking errors.6

Deep Dive into AS/RS Technologies for Heavy Coils

While AS/RS technology encompasses a range of solutions, those designed for heavy industrial coils are highly specialized and robust.

- Unit-Load AS/RS for Coils: This is the predominant technology for heavy coil handling. It features a large stacker crane that travels down the aisle to store or retrieve a single "unit load," which in this case is a single massive coil. These systems are custom-engineered for extreme weight capacities. For instance, Carney Fabricating offers systems for coils weighing upwards of 75,000 lbs (34,000 kgs), while CTI Systems can design solutions for loads as heavy as 40 tonnes (approximately 88,000 lbs).24

- High-Bay and Clad-Rack Warehouses: These terms describe the physical structure of the AS/RS. A high-bay warehouse is a tall AS/RS built within the shell of an existing or new building.23 A clad-rack warehouse is a more structurally integrated and space-efficient design where the racking itself forms the structural skeleton of the building. The exterior walls and roof are attached directly to the racking, eliminating the need for separate building columns and maximizing the use of the land footprint.26

- Specialized Load Handling Devices (LHDs): The LHD is the "hand" of the stacker crane and is critical for safe coil handling. Instead of standard forks, cranes for coil storage are fitted with specialized end effectors, such as automated C-hooks, telescopic coil grabs that grip the coil’s inner diameter from both sides, or trough-shaped conveyors for supporting the coil’s circumference.27

- Integrated Processing Systems: The most advanced implementations blur the line between storage and production. These systems directly link the automated warehouse to processing machinery.

- Krasser Centurio: This system represents the pinnacle of integration. It automates the entire workflow: the system’s software receives an order, selects the correct coil from the automated warehouse, transports it to the processing machine, and automatically feeds it for slitting and cutting. The entire coil changeover process can be completed in less than two minutes with minimal operator involvement.28

- Slinet Dynamic Storage: This solution introduces "dynamic density." Rather than using fixed storage locations designed for a maximum coil size, the system uses sensors to measure the actual, real-time diameter of each coil. The control software then dynamically calculates the most space-efficient placement, allowing, for example, up to 10 coils to be stored in a space traditionally designed for eight. This software-driven optimization unlocks storage capacity that is physically impossible to achieve in a static system.29

System Integration and Control

The seamless operation of an AS/RS depends on a sophisticated, multi-layered ecosystem of software and hardware. This is not a simple product but an integrated infrastructure project. The selection of a vendor should be based as much on their systems integration and software expertise as on their mechanical engineering capabilities. A state-of-the-art crane is of little value if the software controlling it is inefficient or unreliable. The true value is unlocked when hardware and software work in perfect harmony.

- The Software Hierarchy:

- Warehouse Management System (WMS): This is the strategic brain of the operation. The WMS manages the entire inventory database, decides where to store incoming coils based on complex algorithms (e.g., to optimize space or prepare for future orders), and creates transport orders for the machinery. It provides operators with real-time visibility and control over the entire warehouse.30

- Warehouse Control System (WCS) / Machine Control (MC): This is the tactical layer. The WCS receives high-level commands from the WMS (e.g., "retrieve coil #123") and translates them into specific, real-time instructions for the physical equipment. It manages the traffic of cranes and conveyors and executes the movements.31

- Key Hardware Components:

- Programmable Logic Controllers (PLCs): These are ruggedized industrial computers that serve as the direct interface to the machinery. They receive commands from the WCS and control the motors, brakes, and actuators of the crane to execute precise movements.24

- Sensors and Vision Systems: These are the "eyes and ears" of the system. Laser-guided positioning systems ensure the crane aligns perfectly with a storage location.24 Vision systems and sensors can automatically measure a coil’s dimensions upon arrival, verify its identity via barcode or RFID, and detect its precise position for safe gripping by the LHD.6

- Automated Cranes and Mobile Robots: While stacker cranes manage the high-density storage, Automated Guided Vehicles (AGVs) or Autonomous Mobile Robots (AMRs) can be integrated to provide horizontal transport, automatically moving coils from the AS/RS to production lines or shipping bays, creating a fully automated end-to-end workflow.30

The following table summarizes the capabilities of several prominent AS/RS providers specializing in heavy coil applications.

| Provider/System | Max Load Capacity | Max Speed (Lift/Travel) | Key Features & Technologies | Target Application |

|---|---|---|---|---|

| Carney Fabricating | 75,000 lbs (34,000 kgs) 24 | 30 ft/min lift; 0-200 ft/min travel 24 | Laser-guided auto-positioning; PLC/HMI control; guard-locking safety fences. | High-capacity, safe storage for large, heavy coils. |

| CTI Systems | Up to 40 tonnes (~88,000 lbs) 23 | Up to 20 m/min (~65 ft/min) 23 | High-bay, clad-rack, honeycomb, or cantilever designs; stacker cranes. | Bespoke, large-scale automated warehousing for heavy/bulky products. |

| viastore | Up to 6,600 lbs (3,000 kg) 27 | 262 ft/min lift; 787 ft/min travel 27 | Single or double-mast cranes; specialized LHDs for coils/rolls; energy recovery systems. | High-speed, high-flexibility automated warehousing for pallets and round loads. |

| Konecranes | Up to 80 tons 32 | Up to 150 m/min (~492 ft/min) travel 32 | Automated overhead cranes with WMS; smart features (Sway Control); magnetic or mechanical grabs. | Fully automated coil yards and warehouses with integrated logistics. |

| Krasser Centurio | Varies by configuration | High-speed | Fully automated coil exchange and knife positioning; direct integration with slitters/rollformers. | Fully automated "lights-out" processing directly from coil storage. |

| Slinet | 2-ton or 5-ton coils 29 | High-dynamic servo movements | Dynamic storage optimization based on real-time coil diameter; fully electric operation. | Space-optimized, flexible storage integrated with cutting machines. |

The Complete Operational Ecosystem: Handling, Safety, and Compliance

An effective coil storage system does not exist in a vacuum. It is the central hub of a larger operational ecosystem that includes material handling equipment, rigorous safety protocols, and a complex framework of government and industry standards. The success of any storage investment is contingent upon the seamless integration and management of all these elements.

Essential Material Handling Equipment

The efficiency and safety of a coil storage operation are directly dependent on the equipment used to move coils into and out of the racks.

- Overhead Cranes: For facilities handling medium to heavy coils, overhead cranes are the primary material handling workhorse.

- Specifications: Cranes for this application must be engineered for high performance, with lifting capacities that can exceed 80 tons, fast travel speeds of up to 150 m/min to minimize cycle times across large coil yards, and a design life rated for high-duty cycles (up to 8 million cycles) to withstand the demands of continuous operation.32

- Smart Features: Modern cranes are equipped with advanced technologies that enhance both safety and productivity. Features like Sway Control automatically dampen load swing, allowing for faster and more precise positioning. Load Positioning systems can automatically guide the hook to a pre-programmed location, and Overload Protection prevents lifting beyond the crane’s rated capacity.32 For automated systems, PLC control is essential for integration with the warehouse management system.33

- Below-the-Hook Lifting Devices: The interface between the crane hook and the coil is a critical safety component.

- C-Hooks: These are simple, robust, and highly effective lifting tools shaped like a large "C".34 The hook’s arm is inserted into the inner diameter (ID) of the coil, and a counterweight ensures the hook hangs level when empty. They are ideal for applications requiring close, end-to-end stacking of coils. Capacities range from 2.5 to over 50 tons, and they can be customized with protective urethane padding to prevent coil damage or for use in high-temperature environments.34

- Coil Grabs/Lifters/Tongs: These devices offer a more secure grip by engaging the coil from multiple points. Telescoping coil grabs have legs that adjust to the coil’s width and grip the ID from both sides, while other designs grip the outer diameter (OD).35 Motorized rotation and telescoping legs make these lifters ideal for automated systems where precise, remote-controlled positioning is necessary. They generally require less horizontal clearance to operate than C-hooks, making them a better choice for warehouses with narrow aisles.35

- Forklifts: In facilities with manual or semi-automated racking, forklifts are used for loading and unloading. Standard forks are unsafe and unsuitable for handling coils. A forklift must be equipped with a specialized boom attachment (a single pole or ram) that is inserted into the coil’s ID to lift it safely.2

Regulatory and Safety Framework

Compliance with established safety standards is a non-negotiable aspect of operating a coil storage facility. Failure to comply can result in heavy fines, operational shutdowns, and catastrophic accidents.

- OSHA Standards for Material Handling and Storage: The U.S. Occupational Safety and Health Administration provides the primary legal framework for workplace safety.

- 29 CFR 1910.176 (General Industry): This standard is foundational. It broadly requires that "Storage of material shall not create a hazard." More specifically, it mandates that any materials stored in tiers must be "stacked, blocked, interlocked and limited in height so that they are stable and secure against sliding or collapse".10 This rule effectively prohibits the unsafe stacking of coils without proper engineering controls like racking or chocking. It also requires that aisles and passageways be kept clear and in good repair.10

- 29 CFR 1926.250 (Construction): While aimed at construction sites, this standard offers more explicit and relevant guidance. Section 1926.250(a)(1) reiterates that "All materials stored in tiers shall be stacked, racked, blocked, interlocked, or otherwise secured to prevent sliding, falling or collapse".36 Critically, section 1926.250(b)(9) states that "Structural steel, poles, pipe, bar stock, and other cylindrical materials, unless racked, shall be stacked and blocked so as to prevent spreading or tilting".36 This directly applies to metal coils. The standard also requires that the maximum safe load limits of floors be conspicuously posted.36

- Industry Design and Safety Standards:

- ANSI MH16.1: Published by the Rack Manufacturers Institute (RMI), this is the definitive American National Standard for the "Specification for the Design, Testing and Utilization of Industrial Steel Storage Racks." Compliance with this standard ensures that a racking system is structurally sound and capable of safely supporting its intended loads.21

- AISC (American Institute of Steel Construction): For heavy-duty structural steel racking, manufacturers often design to the rigorous specifications set by AISC, which are the same standards used for designing steel buildings and bridges. This signifies a higher level of engineering and safety assurance.2

- Personal Protective Equipment (PPE): A baseline safety program must mandate the use of appropriate PPE for all personnel working in or near coil handling areas. This includes, at a minimum, steel-toed boots, heavy-duty gloves to protect from sharp edges, and safety glasses.8

The following table serves as a high-level checklist to guide compliance efforts.

| Standard/Regulation | Key Requirement Summary | Application to Coil Storage | Compliance Action Item |

|---|---|---|---|

| OSHA 29 CFR 1910.176(b) | Tiered material must be stable and secure against collapse. | Prohibits unstable stacking of coils on the floor. | Implement an engineered racking or blocking system. |

| OSHA 29 CFR 1926.250(b)(9) | Cylindrical materials must be racked or blocked to prevent rolling/tilting. | Directly mandates that coils cannot be stored loose on the floor. | Procure and install racking systems with cradles or floor-based chocks. |

| OSHA 29 CFR 1926.250(a)(2) | Maximum safe floor loads must be posted in storage areas. | Ensures the combined weight of racks and coils does not exceed slab capacity. | Conduct a structural analysis of the floor slab and post load limit signs. |

| OSHA 29 CFR 1910.176(a) | Aisles and passageways must be kept clear. | Prevents obstructions that could lead to forklift or personnel accidents. | Maintain clear aisle markings and enforce strict housekeeping rules. |

| ANSI MH16.1 | Provides technical specifications for the design and testing of steel racks. | Ensures the racking system itself is structurally sound for the intended loads. | Specify that any procured racking system must be designed in accordance with ANSI MH16.1. |

| AISC 360 | Provides specifications for the design of structural steel. | Ensures heavy-duty structural racks are built to the highest engineering standards. | For heavy-duty applications, select a manufacturer that designs to AISC standards. |

Seismic Engineering for Industrial Racking (California Focus)

For facilities in seismically active regions, particularly California, seismic engineering is not an optional accessory; it is a fundamental and legally mandated component of the design and installation process.

- The Regulatory Environment: California is designated as a high-seismic region (Seismic Zone 4). The California Building Code (CBC) reflects this risk with stringent regulations. Any industrial storage rack over 8 feet in height (and in some municipalities, even lower) must be formally engineered for seismic forces and receive a building permit prior to installation.37 Furthermore, for racks assigned to high Seismic Design Categories (D, E, or F), the CBC mandates periodic special inspections to ensure their continued integrity.38

- Engineering Requirements: A seismic design is a highly specialized process that goes far beyond standard rack calculations.

- Site-Specific Analysis: A licensed professional engineer must perform a detailed analysis based on the specific project address to determine the ground motion parameters. This analysis also considers the properties of the building’s concrete slab and the underlying soil, as these factors significantly influence how seismic forces are transmitted to the rack structure.39

- Specialized Components: Seismically designed racks incorporate specific features to withstand lateral and vertical forces. This includes significantly larger and thicker footplates (e.g., 6-inch x 8-inch) with additional anchor holes to provide a more robust connection to the floor slab.40 The type, diameter, and embedment depth of the anchor bolts are also precisely specified by the engineer.

- Frame Design: The structural frame itself may be designed for seismic resilience. Hannibal Industries’ patented TubeRack, for example, uses a "dual movement" frame design that allows for controlled flexibility both front-to-back and side-to-side. This allows the rack to dissipate seismic energy more effectively, reducing the potential for catastrophic failure.41 Bolted connections are often preferred over welded ones in seismic designs because they can offer more predictable ductility.40

- The Permitting Process: The path to a compliant installation is a formal one. A complete set of PE (Professional Engineer) stamped calculations and detailed drawings showing the rack system, facility layout, component details, and anchorage specifications must be submitted to the local city or county building department for review and approval before any installation work can begin.17 This process requires time and has associated fees that must be factored into the project schedule and budget.

The implications of this regulatory landscape are profound. A company operating in California cannot simply purchase racking from a catalog and install it. They must engage in a comprehensive design-build process that begins with a seismic engineering consultant. The choice of racking material is heavily influenced by these requirements, with structural steel being inherently more suitable and easier to engineer for high seismic loads than lighter roll-formed steel. Attempting to bypass this process by installing non-compliant racking is a major financial and safety risk, as a building inspector has the authority to red-tag the system and halt its use until it is brought into full compliance.17

Financial Analysis and Investment Justification

A thorough financial analysis is the cornerstone of any capital investment decision. For multilevel coil storage systems, this analysis must extend beyond the initial purchase price to encompass the total cost of ownership (TCO) and a realistic assessment of the return on investment (ROI). The data reveals that while initial outlays can be substantial, the long-term financial benefits of modern, engineered systems are often compelling.

Deconstruction of System Costs

The total cost of a coil storage solution is a composite of material costs, system-specific pricing, and a variety of "soft" costs that are critical to budget for.

- Raw Material Costs: The price of the system is fundamentally tied to the commodity price of steel. As a key input for both roll-formed and structural racking, fluctuations in the steel market directly impact project costs. For reference, the US Midwest hot-rolled coil index, a common benchmark, can vary significantly. Sample data shows prices around $44.13 per hundredweight (cwt), which translates to approximately $882 per ton.42 Other analyses place the raw cost of steel for manufacturing in the range of $361-$514 per ton.43 This volatility underscores the importance of obtaining current quotes during the procurement process.

- System Pricing Models: The price of a system varies dramatically based on its type, capacity, and complexity.

- Cost per Position/Unit: This model is common for manual racking. Basic selective pallet racking might cost $250-$450 per pallet position. Higher-density systems are more expensive, with push-back racking ranging from $1,600-$2,500 per position and automated shuttle systems costing $3,500-$5,000 per position.43 For coil-specific components, simple floor chocks or racks for flatbed trucks can be as low as $11-$31 per unit 44, while heavy-duty industrial coil rack sets from some suppliers are priced around $450-$500 per set.45 A complete bay of seismic-rated pallet rack (which could be adapted for coils) might cost around $350 for an 8-foot-high unit.46

- AS/RS Pricing: Automated systems represent a major capital expenditure. The investment is highly dependent on the system’s size, height, throughput, and level of customization. General starting price points are:

- "Soft" Costs: These are essential but often underestimated expenses. A comprehensive budget must include fees for professional engineering (especially seismic analysis), building permits, freight and shipping, professional installation labor, and system-specific training for operators and maintenance staff.25 For a VLM, installation alone can start at $12,000.47

The following table provides a simplified cost spectrum to help frame budget expectations.

| Solution Tier | System Type | Estimated Initial Cost (CapEx) | Key Cost Drivers | Estimated Long-Term OpEx | Typical ROI Payback |

|---|---|---|---|---|---|

| Basic Manual | Floor-based polymeric/wood chocks | $5,000 – $30,000 | Number of coil positions, material choice (wood vs. polymer) | High (Labor, damage, space) | N/A (Baseline) |

| Standard Manual Racking | Roll-formed selective or cantilever rack | $20,000 – $150,000+ | Weight capacity, number of bays, height, steel prices | Medium (Labor, forklift costs) | 2-5 Years |

| Heavy-Duty Seismic Manual | Structural I-beam rack (coil or cantilever) | $50,000 – $500,000+ | Seismic zone, weight capacity, engineering/permitting complexity | Low to Medium (Reduced damage/repairs) | 1-3 Years |

| Full AS/RS | Unit-load crane-based system | $1,000,000 – $5,000,000+ | Height, capacity, throughput, software customization | Low (Minimal labor, high efficiency) | 6 – 18 Months 48 |

Total Cost of Ownership (TCO) Modeling

A TCO analysis provides a more accurate financial picture than purchase price alone by evaluating all costs over the system’s entire operational life.49 This includes both Capital Expenditures (CapEx) for the initial purchase and installation, and all subsequent Operational Expenditures (OpEx), such as energy, maintenance, repairs, labor, and the costs associated with downtime.

- Comparative TCO: Polymeric vs. Wood Blocking: A detailed TCO analysis comparing a modern polymeric block system to a traditional wood block system over a 30-year life for 50 floor-level coils provides a stark example.

- Initial Cost (CapEx): The polymeric system is more expensive upfront ($31,000) than the wood system ($14,450).4

- Lifecycle Costs (OpEx): The wood blocks require frequent replacement (e.g., every 4 years), and the associated chains also have a limited life. These recurring replacement costs, combined with disposal costs and higher labor costs for handling, cause the wood system’s cumulative cost to skyrocket over time.

- 30-Year Outcome: The analysis concludes that the future value of all expenditures for the wood system approaches $2 million. In contrast, the durable polymeric system’s cost remains at its initial $31,000. This results in a Net Present Value (NPV) savings of over $338,000 for the polymeric system, representing a return of over 1,000% versus the wood system.4 This demonstrates how a higher initial investment can lead to dramatically lower total costs.

- Comparative TCO: Manual Racking vs. AS/RS:

- Manual Racking TCO: Characterized by lower CapEx but higher and more unpredictable long-term OpEx. Key OpEx drivers include the direct wages and benefits for forklift operators and warehouse staff, the cost of operating and maintaining a fleet of forklifts, higher energy consumption, and the financial impact of inventory damage and picking errors caused by manual handling.25

- AS/RS TCO: Defined by very high CapEx but significantly lower and more predictable long-term OpEx. Labor costs are drastically reduced. The precise, gentle handling minimizes product damage and waste. The high-density nature of the system can eliminate the immense cost of building or leasing additional warehouse space. Key OpEx components to factor in are scheduled preventative maintenance, software support contracts, and electricity consumption.25

Return on Investment (ROI) and Real-World Case Studies

The ROI for an advanced storage system is driven by a combination of direct cost savings and unlocked operational capacity. The business case for a high-cost automated system becomes particularly powerful when it is framed not as a storage expense, but as a strategic investment that avoids an even larger expense (like a new building) and enables new revenue growth.

- Key ROI Drivers:

- Space Savings: This is often the most significant driver. An AS/RS can recover up to 90% of the floor space occupied by traditional storage methods.48 One case study noted that by increasing storage capacity by 30% with a modern system, a company avoided the need for an additional 15,000 square feet of warehouse space, representing a capital cost avoidance of nearly $600,000.5

- Labor Savings: Automation allows one operator to perform the work of several, leading to direct savings in wages, benefits, and training costs. Industry studies suggest productivity can be boosted by up to 85%.48 One real-world case study documented an annual labor savings of $660,000 by implementing an optimized automated system instead of adding more manual workstations.50

- Throughput and Accuracy: Faster, more accurate order fulfillment allows a company to process more orders and generate more revenue from its existing facility. Eliminating picking errors also cuts the significant costs associated with returns, rework, and customer dissatisfaction.48

- Damage Reduction: The precise and gentle handling of automated systems minimizes material damage, reducing scrap rates and improving overall product quality and yield.6

- Case Study Evidence:

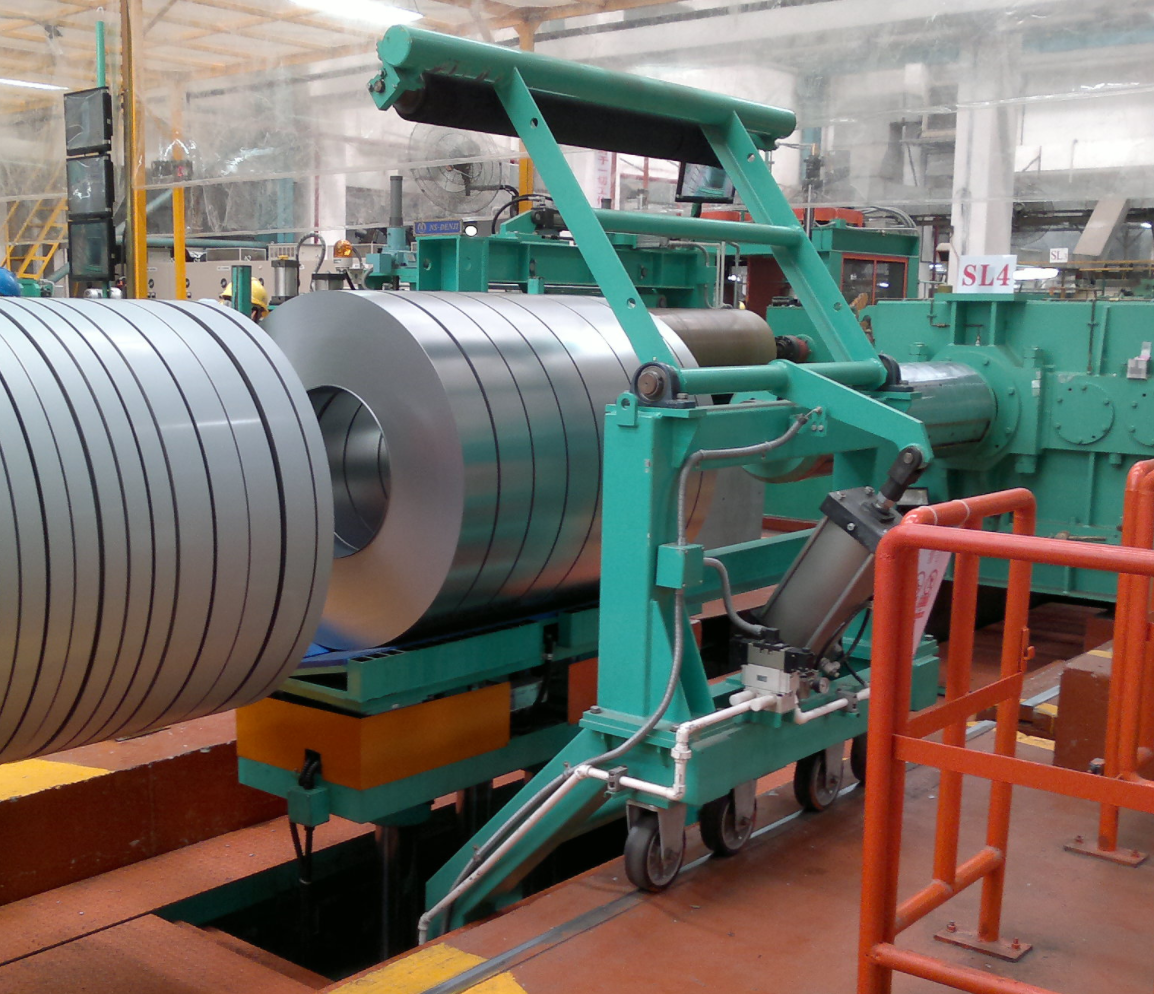

- Raynor Garage Doors: Faced with limited space for their 8,000 lb aluminum coils, Raynor replaced their existing 2-tier racks with a 3-tier heavy-duty structural coil rack system from Dexco. This immediately increased their storage capacity, allowing them to stock a wider variety of colors to meet customer demand. The move to a more robust structural rack also enhanced plant safety and improved material handling efficiency.16

- JSW Steel: The implementation of an integrated AS/RS and Yard Management System (YMS) from Pesmel was credited with significantly accelerating their production ramp-up, improving on-time delivery, and reducing coil damage, leading to a confirmed ROI.6

- SteelTech Inc.: By applying automated inventory tracking systems, SteelTech achieved a 15% reduction in operating costs and a 20% increase in throughput within the first year of implementation.6

- ROI Payback Period: The time it takes for the accumulated savings and benefits to equal the initial investment is a key metric. For AS/RS projects, despite the high upfront cost, the payback period is often surprisingly short. Most sources and case studies indicate a typical ROI payback period ranging from just 6 to 18 months.48

Supplier Landscape and Implementation Roadmap

Successfully transitioning to a new coil storage system requires more than just selecting the right hardware; it involves choosing the right partners and following a structured implementation process. This is particularly true for complex projects involving automation or seismic engineering.

Vetting and Selecting Partners

The market for coil storage solutions is comprised of different types of companies, and understanding their roles is crucial for selecting the right partner for your project’s scope.

- Manufacturers: These are the companies that fabricate the physical racking components. Examples include Ross Technology (Dexco), which specializes in heavy-duty structural I-beam racks, and Steel King, which produces a range of racking including cantilever systems.2 Buying from a manufacturer can be beneficial for large or highly custom projects.

- Distributors: These companies act as resellers for one or more manufacturers. Examples include Rack and Shelf, LLC and SJF Material Handling.9 A good distributor offers a wide selection of products, holds inventory for faster lead times, and often provides design and layout services.

- Integrators: System integrators are essential for complex and automated projects. They design and implement complete, turnkey systems by combining hardware (racks, cranes, conveyors) and software (WMS, WCS) from various manufacturers into a single, cohesive solution. Companies like Bastian Solutions, Konecranes, and Honeywell Intelligrated specialize in this role, providing project management, engineering, and software development.30

For any significant project, especially those involving heavy loads or seismic considerations, key selection criteria should include: proven experience with heavy coil storage applications, in-house or tightly partnered engineering capabilities, and the ability to provide turnkey services from initial design through permitting, installation, and long-term lifecycle support.51

Directory of Key Suppliers and Consultants (California Focus)

The California market, with its high industrial demand and stringent seismic codes, has a specialized ecosystem of suppliers and consultants equipped to handle these unique challenges.

- Heavy-Duty & Seismic Racking Manufacturers/Suppliers:

- Ross Technology (Dexco): A leading manufacturer of heavy-duty structural I-beam coil racks engineered to AISC standards, with capacities up to 80,000 lbs.2

- Warehouse Rack & Shelf LLC: A key California supplier with manufacturing in San Diego and distribution from Los Angeles. They specialize in seismic pallet rack and explicitly offer free seismic analysis and permitting services as part of their package.17

- Hannibal Industries (TubeRack): A California-based manufacturer known for its patented "earthquake pallet rack" design, which uses a flexible dual-movement frame to better withstand seismic events. Their systems are available through master dealers like Conveyor & Storage Solutions (C&SS).41

- Interlake Mecalux: A global manufacturer with a presence in San Diego and a US office in Chicago, offering a range of racking systems, including bolted pallet rack with seismic footplates that are stocked in California.52

- SJF Material Handling: A national supplier that designs, engineers, and installs custom structural steel coil racks built to AISC standards, offering full turnkey project management.51

- Other CA-based or serving suppliers: A network of regional distributors and installers includes QMH, Inc. (Rancho Cucamonga), Ziglift Material Handling (Santa Fe Springs), and Material Handling & Storage, Inc. (MHS) (serving Northern California).53

- Cantilever Rack Suppliers (Los Angeles Area):

- Raymond West: A major supplier with locations in Cypress and Valencia, providing new and used cantilever rack solutions to Los Angeles County and the San Fernando Valley.54

- Shelf Master: An Anaheim-based company with over 40 years of experience serving Southern California, offering a range of cantilever racks including standard, light-duty, and heavy-duty I-beam models.55

- The Rack Depot, Inc.: Located in Santa Fe Springs, this company offers full warehouse services including design, engineering, permitting, and installation for cantilever rack systems throughout Southern California.56

- Camara Industries: A distributor serving the Los Angeles market with a focus on providing engineered products that comply with high seismic zone requirements.57

- AS/RS System Integrators (Serving California):

- Bastian Solutions: A prominent national integrator with a presence in Carmel, IN, that designs and installs sophisticated AS/RS solutions for various industries, including automotive and manufacturing.58

- Konecranes: A global leader in lifting equipment, offering fully automated coil warehouse solutions that integrate their advanced cranes with a proprietary Warehouse Management System (WMS).30

- Honeywell Intelligrated: A major technology company that provides comprehensive AS/RS shuttle solutions powered by their advanced Momentum Warehouse Execution System (WES) software.31

- Autoquip: This company specializes in creating custom material handling equipment, such as vertical reciprocating conveyors (VRCs) and lift tables, that are specifically designed to integrate with AS/RS from other major vendors, bridging the gap between systems.59

- Other CA-based or serving integrators: The California market is served by numerous integrators, including FloStor (Hayward), MWI Solutions (Orange), and Wynright Corporation (Chino).58

- Seismic Engineering Consultants (California):

- Next Level Storage: Provides professional seismic engineering services for both new and existing warehouse rack structures, with specific experience navigating California’s requirements.39

- Storage Rack Engineering: A highly specialized consulting firm based in Rancho Santa Margarita, CA, that focuses exclusively on the seismic engineering of material handling structures.60

- Coffman Engineers: A large, multidisciplinary engineering firm with multiple California offices and deep expertise in advanced performance-based seismic design and structural retrofitting.61

- Optimum Seismic: A Los Angeles-based structural engineering firm specializing in earthquake retrofits for commercial and industrial buildings.62

- Erusu Consultants: A Los Angeles firm that provides structural design and seismic retrofitting services for industrial complexes.63

A Phased Implementation Framework

A structured, phased approach is essential for a successful project, ensuring that all technical, regulatory, and operational requirements are met.

- Phase 1: Needs Assessment & Data Collection: The project begins with internal data gathering. This involves precisely defining the storage requirements: the full range of coil diameters, widths, and weights; the total number of coils to be stored; and the required throughput (coils moved per shift/day). A detailed survey of the facility’s physical constraints, including clear ceiling height and floor slab specifications, is also mandatory.64

- Phase 2: Conceptual Design & Partner Selection: Armed with data, the facility can engage with potential partners. This phase involves working with engineering consultants and integrators to develop preliminary system layouts and concepts. Partners should be vetted based on their demonstrated experience with similar projects, their engineering capabilities (especially seismic), and their ability to provide a turnkey solution.

- Phase 3: Detailed Engineering & Permitting: Once a partner is selected, they will develop detailed, PE-stamped engineering drawings and calculations for the chosen system. These documents are then formally submitted to the local building department to obtain the necessary permits. In California, this is a critical-path activity that can take a significant amount of time and must be completed before any fabrication or installation can begin.17

- Phase 4: Procurement & Fabrication: With permits approved, the manufacturing of the racking, machinery, and control system components can commence.

- Phase 5: Installation & Commissioning: Professional, licensed installation crews erect the mechanical structures on-site. For an AS/RS, this is a major undertaking that includes mechanical and electrical installation, followed by the complex process of software integration, system testing, and commissioning to ensure all components work together as designed.

- Phase 6: Training & Go-Live: Before the system is put into full operational use, comprehensive training must be provided to all operators and maintenance personnel. This ensures safe and efficient operation and is a critical step for maximizing the system’s long-term value and ROI.25

Conclusion and Strategic Recommendations

Synthesis of Findings

The analysis of multilevel coil storage solutions reveals a clear progression from simple, low-cost static systems to highly complex, high-investment automated infrastructures. The journey from floor stacking to a fully automated warehouse is marked by a series of strategic trade-offs between capital outlay, storage density, inventory selectivity, operational efficiency, and safety. There is no single "best" solution; rather, the optimal choice is entirely contingent on the specific context of the user’s operation—their inventory profile, throughput demands, labor environment, and long-term business objectives.

Manual racking systems, including standard selective, cantilever, and modular designs, offer significant improvements over floor storage in safety, organization, and space utilization at a moderate capital cost. The critical decision within this tier lies in selecting the right architecture for the inventory mix and, most importantly, choosing between lower-cost roll-formed steel and more durable, impact-resistant structural steel. In demanding environments and seismic zones, the evidence strongly suggests that the higher initial cost of structural steel is a prudent investment that yields a lower total cost of ownership.

Fully Automated Storage and Retrieval Systems (AS/RS) represent a paradigm shift. They offer unparalleled density and throughput, transforming the warehouse from a cost center into a strategic asset that can drive growth and obviate the need for facility expansion. The investment is substantial, but the ROI, driven by massive reductions in labor, space requirements, and product damage, can be remarkably swift. The selection of an AS/RS is less about buying a product and more about choosing a long-term technology and integration partner.

The Decision-Making Matrix

To guide the final selection process, this matrix plots the primary storage solution tiers against the key operational and financial criteria that define a facility’s needs. An organization can identify its position on this matrix to quickly narrow down the most appropriate solutions for further investigation.

| Decision Criteria | Basic Manual Racking (e.g., Selective, Polymeric) | High-Density Manual Racking (e.g., Double-Deep, Cantilever) | Fully Automated System (AS/RS) |

|---|---|---|---|

| Capital Budget | Low ($) | Medium ($$) | Very High ($$$$) |

| Storage Density | Low to Medium | High | Very High |

| Inventory Selectivity | 100% | 50% (Double-Deep) to 100% (Cantilever) | 100% |

| Throughput Requirement | Low to Medium | Medium | Very High |

| Inventory Profile | High SKU mix, low volume per SKU | Low SKU mix, high volume per SKU | High or Low SKU mix, high volume |

| Labor Dependency | High | High | Very Low |

| Safety Profile | Good (vs. floor) | Good (vs. floor) | Excellent (Minimal human interaction) |

| Seismic Suitability | Requires significant engineering | Requires significant engineering | Racking structure must be heavily engineered |

| Ideal User Profile | Small fabricators, low-volume service centers, facilities prioritizing selectivity over density. | High-volume distributors with limited SKUs, operations storing long products or varied coil widths. | Large-scale steel mills, high-volume service centers, 24/7 manufacturing plants, facilities facing space constraints. |

Final Strategic Recommendation

The decision to invest in a new multilevel coil storage system is a significant undertaking with long-term consequences for a company’s safety, efficiency, and profitability. It should be approached with the rigor of a major strategic initiative, not a tactical equipment purchase.

The final and most critical recommendation is to proceed with a formal, data-driven Total Cost of Ownership (TCO) and Return on Investment (ROI) analysis based on the frameworks and data presented in this report. This requires a meticulous audit of the current operation to establish a financial baseline, quantifying the costs of wasted space, inventory damage, labor inefficiencies, and safety risks. This baseline will serve as the foundation for building a powerful and undeniable business case for the proposed investment. By comparing the full lifecycle costs and benefits of the most suitable options identified from the decision matrix, an organization can confidently select and justify the system that will not only solve its current storage challenges but also serve as a scalable platform for future growth and a safer, more productive work environment.

Works cited

-

Selective Storage Systems: Types | AR Racking Inc, accessed June 18, 2025, https://www.ar-racking.com/us/blog/types-of-pallet-racking-differences-and-advantages-2/

-

Steel Coil Racks & Industrial Coil Storage Rack Systems – Ross Technology, accessed June 18, 2025, https://www.rosstechnology.com/industrial-storage/dexco-structural-i-beam-coil-rack-systems/

-

The Cost of Automated Storage & Retrieval Systems: ASRS Prices & Contributing Factors, accessed June 18, 2025, https://www.kardex.com/en-us/blog/asrs-cost-factors

-

Coil Storage: Implementing a Safe, Economical Program – Philpott Solutions Group, accessed June 18, 2025, https://philpottsolutions.com/wp-content/uploads/2020/05/Implementing-Safe-Economical-Coil-Storage-Program.pdf

-

Steel Coil Storage – Philpott Solutions Group, accessed June 18, 2025, https://philpottsolutions.com/case-study-coil-safety-storage/

-

Research on Steel Coil Storage, Logistics, and Packaging Automation – FhopePack, accessed June 18, 2025, https://www.fhopepack.com/zh/research-on-steel-coil-storage-logistics-and-packaging-automation/

-

Dexco Structural I-Beam & Industrial Coil Storage Rack Systems – TCR, Inc., accessed June 18, 2025, https://www.stampingsystems.com/dexco-coil-racking-systems/

-

Key Safety Guidelines for Steel Coil Handling and Transport – FhopePack, accessed June 18, 2025, https://www.fhopepack.com/zh/key-safety-guidelines-for-steel-coil-handling-and-transport/

-

Steel Coil Storage Racks, accessed June 18, 2025, https://rackandshelf.com/product/storage-products/automotive/automotive-racks/coil-racks/

-

1910.176 – Handling materials – general. | Occupational Safety and Health Administration, accessed June 18, 2025, https://www.osha.gov/laws-regs/regulations/standardnumber/1910/1910.176

-

Steel Coil Racking | Online 3D Viewer, accessed June 18, 2025, https://www.plexformps.com/online-3d-viewer-steel-coil-racking/

-

COIL STORAGE SYSTEMS – Lankhorst Engineered Products, accessed June 18, 2025, https://www.lankhorst-ep.com/files/9/3/0/8/Coil%20storage%20systems%20-%20total%20-%20eng.pdf

-

Heaviest Duty Structural I-Beam Slit Coil Racking – Warehouse Rack and Shelf, accessed June 18, 2025, https://rackandshelf.com/product/storage-products/warehouse-racks/specialty-racks/heaviest-duty-structural-i-beam-slit-coil-racking/

-

Pallet Racking (selective system) – Interlake Mecalux, accessed June 18, 2025, https://www.interlakemecalux.com/warehouse-racking/pallet-racking

-

Heavy-Duty Cantilever Storage Racks | I-Beam Racking – Ross Technology, accessed June 18, 2025, https://www.rosstechnology.com/industrial-storage/dexco-structural-i-beam-cantilever-rack-systems/

-

Raynor Coil & Wide Span Storage Racks | Case Study | Dexco – Ross Technology, accessed June 18, 2025, https://www.rosstechnology.com/news/case-study-safe-storage-for-heavy-coils-and-steel-headplates/

-

Warehouse Rack & Shelf LLC the Seismic Pallet Rack Specialists, accessed June 18, 2025, https://rackandshelf.com/product/storage-products/warehouse-racks/warehouse-rack-shelf-llc-the-seismic-pallet-rack-specialists/

-

Heavy Duty Cantilever Racking | Quality Systems by Steel King, accessed June 18, 2025, https://www.steelking.com/products/cantilever-rack-2/

-

Cantilever racking – for all industries – OHRA, accessed June 18, 2025, https://www.ohra.net/cantilever-racking

-

Cantilever Racking Specialists – Get the Right Racks | SJF.com, accessed June 18, 2025, https://www.sjf.com/cantilever_rack.html

-

Cantilevered Storage Rack Safety 101, accessed June 18, 2025, https://www.rmiracksafety.org/2018/04/20/cantilevered-storage-rack-safety-101/

-

Tips to Ensure Safe Indoor & Outdoor Cantilever Racking | Apex Safety Spotlight, accessed June 18, 2025, https://www.apexwarehousesystems.com/tips-to-ensure-safe-indoor-outdoor-cantilever-rack-apex-safety-spotlight/

-

Storage Systems – CTI Systems – Reels & Coils – Intralogistics, accessed June 18, 2025, https://www.ctisystems.com/reels-coils-paper-foil-cardboard/storage-systems-en/

-

Coil Handling, Storage & Management – Carney Fabricating, accessed June 18, 2025, https://www.carneyfabricating.com/automated-coil-storage-and-retrieval-systems-asrs/

-

How Much Does it Cost to Install an Automatic Storage System (ASRS)?, accessed June 18, 2025, https://www.sstlift.com/blog/how-much-does-it-cost-to-install-automatic-storage-system-asrs

-

Coil Storage Racking | Reel Rack – AR-Racking, accessed June 18, 2025, https://www.ar-racking.com/us/industrial-racking/other-storage-solutions/specific-storage-solutions/coil-racking/

-

Stacker cranes – storage and retrieval systems from viastore, accessed June 18, 2025, https://www.viastore.com/systems/en/warehouse-and-material-flow-solutions/stacker-cranes

-

Automated Coil Processing Machine & Solutions | MetalForming, LLC., accessed June 18, 2025, https://www.metalforming-usa.com/krasser-centurio-coil-storage-and-handling/

-

Fully automativc coil storage system – Slinet, accessed June 18, 2025, https://www.slinet.de/en/coil-storage-system/

-

Warehouse Management System for coil storage – Konecranes, accessed June 18, 2025, https://www.konecranes.com/en-us/industries/metals-production/the-strength-of-experience/warehouse-management-system-for-coil-storage

-

Automated Storage and Retrieval Systems (AS/RS) | Honeywell, accessed June 18, 2025, https://automation.honeywell.com/us/en/products/warehouse-automation/solutions-by-technology/asrs-systems

-

Coil and plate handling cranes – Konecranes, accessed June 18, 2025, https://www.konecranes.com/industries/metals-production/equipment-for-lifting-metals/coil-and-plate-handling-cranes

-

PLC Control Coil Handling Overhead Cranes | Sinokocranes, accessed June 18, 2025, https://www.sinokocrane.com/p-1383/PLC-Control-Coil-Handling-Overhead-Cranes-with-Smart-Function.html

-

C-Hooks | AVON Engineering, accessed June 18, 2025, https://www.avonengineering.com/below-hook-lifting/c-hooks/

-

Coil Lifters | Bradley Lifting, accessed June 18, 2025, https://www.bradleylifting.com/lifting-devices/coil-lifters/

-

1926.250 – General requirements for storage. | Occupational Safety and Health Administration, accessed June 18, 2025, https://www.osha.gov/laws-regs/regulations/standardnumber/1926/1926.250

-

Seismic Safety Inspections – Warehouse Solutions, accessed June 18, 2025, https://warehousesolutions.com/seisemic-safety-inspections/

-

2022 California Building Code, Title 24, Part 2 (Volumes 1 & 2) – CHAPTER 17 SPECIAL INSPECTIONS AND TESTS – 1705.13.7 Storage racks., accessed June 18, 2025, https://codes.iccsafe.org/s/CABC2022P1/chapter-17-special-inspections-and-tests/CABC2022P1-Ch17-Sec1705.13.7

-

Seismic Engineering Services – Next Level, accessed June 18, 2025, https://nextlevelstorage.com/services/seismic-engineering/

-

Enhancing Warehouse Safety: Seismic Bracing and Racking Strategies, accessed June 18, 2025, https://www.qmhinc.com/seismic-bracing-racking/

-

Earthquake Pallet Rack | High Seismic TubeRack in CA | HMH, accessed June 18, 2025, https://www.cssyes.com/product/earthquake-pallet-rack-ca/

-

Average Weekly Steel Prices – Apex Warehouse Systems, accessed June 18, 2025, https://www.apexwarehousesystems.com/steel-index/

-

Cost Of Pallet Racking – OKE Storage, accessed June 18, 2025, https://www.okestorage.com/cost-of-pallet-racking/

-

Heavy Duty Coil Racks for Steel Coil Bundles Securement – Mytee Products, accessed June 18, 2025, https://www.myteeproducts.com/coil-rack-heavy-duty.html

-

Heavy Duty Steel Coil Storage Rack – NANJING TOCO WAREHOUSE EQUIPMENT CO., LTD., accessed June 18, 2025, https://tocorack.en.made-in-china.com/product/gSFJLpTKYyYm/China-Heavy-Duty-Steel-Coil-Storage-Rack.html

-

Seismic Pallet Rack | Warehouse Solutions – Move it, Lift it, Store it, accessed June 18, 2025, https://www.apluswhs.com/racks/pallet-racking/seismic-pallet-rack/v/seismic-pallet-rack-5bs096p

-

How Much Does a Vertical Carousel Storage System Cost in 2023? – Modula, accessed June 18, 2025, https://modula.us/blog/vertical-carousel-storage-system-cost/

-

The Quick ROI of Automated Storage and Retrieval Systems – Modula, accessed June 18, 2025, https://modula.us/blog/roi-automated-storage-and-retrieval-systems/

-

The Real Cost of Automated Storage? It’s Not What You Think. – Vidir Vertical Solutions, accessed June 18, 2025, https://vidirsolutions.com/blogs/the-real-cost-of-automated-storage

-

Warehouse Automation ROI – ISD – Integrated Systems Design, accessed June 18, 2025, https://www.isddd.com/warehouse-automation-roi/

-

Steel Coil Racks & Coil Storage Racks for Sale – SJF Material Handling, accessed June 18, 2025, https://www.sjf.com/coil-racks.html

-

Interlake Pallet Rack W/Seismic plates | Warehouse Solutions – Move it, Lift it, Store it, accessed June 18, 2025, https://www.apluswhs.com/racks/pallet-racking/interlake-bolted-pallet-rack-with-seismic-footplates

-

Warehouse Racks Suppliers located in California – Southern – Thomasnet, accessed June 18, 2025, https://www.thomasnet.com/suppliers/southern-california/all-cities/warehouse-racks-65730202

-

Cantilever Rack | Los Angeles – Raymond West, accessed June 18, 2025, https://www.raymondwest.com/los-angeles-ca/material-handling-equipment-supplier/racking/cantilever

-

cantilever racks anaheim Archives – Shelf Master, accessed June 18, 2025, https://www.shelfmaster.com/tag/cantilever-racks-anaheim/

-

Cantilever Racks – Buy New and Used | The Rack Depot, Inc., accessed June 18, 2025, https://rackdepot.us/cantilever-rack/

-

Used and New Storage Racks Los Angeles – Camara Industries, accessed June 18, 2025, https://camaraindustries.com/article/los-angeles/

-

Automated Storage/Retrieval Systems (AS/RS) Suppliers located in California – Southern, accessed June 18, 2025, https://www.thomasnet.com/suppliers/southern-california/all-cities/automated-storage-retrieval-systems-as-rs-2243038

-

Benefits of AS/RS Integration with Custom Material Handling Solutions | Autoquip, accessed June 18, 2025, https://autoquip.com/blog/benefits-of-asrs-integration-with-custom-material-handling-solutions/

-

Storage Rack Engineering: Rack Design Services, accessed June 18, 2025, https://storagerackengineering.com/

-

Seismic & Earthquake Engineering – Coffman Engineers, accessed June 18, 2025, https://www.coffman.com/services/seismic/

-

Earthquake Engineering & Building Design Services – Optimum Seismic, accessed June 18, 2025, https://www.optimumseismic.com/seismic-engineering-services/

-

The Best Seismic Retrofitting Services in California – Erusu Consultants, accessed June 18, 2025, https://erusuconsultants.com/seismic-retrofit/

-

Cantilever Rack Guide (New & Used) | SJF.com, accessed June 18, 2025, https://www.sjf.com/cantilever-storage-racks.html