A Comprehensive Cost Analysis: Manual vs. Automatic Steel Coil Packaging Lines

Executive Summary

This report presents a detailed, comprehensive cost analysis of manual versus automated methodologies in steel coil packaging operations. The objective is to provide a data-driven, strategic framework for capital investment decisions within steel manufacturing and processing enterprises. The analysis reveals that while manual packaging offers a low initial capital expenditure (CapEx), it is burdened by high and volatile operational expenditures (OpEx) and significant, often underestimated, indirect costs stemming from high injury rates, product damage, material waste, and production inefficiencies. These factors combine to create an unsustainable operational model that severely constrains growth potential.

In contrast, a fully automated coil packaging line, despite its significant upfront investment, delivers a swift and compelling return on investment (ROI). Automation fundamentally alters the cost structure by drastically reducing labor expenses, optimizing consumable material usage by 30% to 66%1, minimizing product damage rates, and dramatically improving workplace safety. Furthermore, automation increases the line’s capacity by an order of magnitude, from a few coils per hour to 20-301, effectively eliminating the packaging stage as a production bottleneck.

The core conclusion of this report is that the transition from manual to automated packaging should not be viewed merely as a cost-cutting measure, but as a strategic investment in operational risk reduction, product quality enhancement, customer satisfaction, and foundational readiness for Industry 4.0 and "lights-out" factory paradigms. A phased "crawl-walk-run" implementation strategy makes this transition financially viable and self-sustaining, allowing enterprises to leverage savings from one stage to fund the next2. Ultimately, the data demonstrates that for any coil handling operation seeking to remain competitive, investing in an automated packaging line is a critical move to ensure long-term profitability and operational excellence.

Section 1: The Manual Steel Coil Packaging Paradigm: A Cost and Risk Analysis

This section establishes a comprehensive baseline by dissecting the true, fully-loaded costs and inherent risks of the traditional manual packaging status quo. The central thesis is that the low initial cost of manual tools masks a deep and unsustainable structure of high variable costs, profound safety risks, and the significant "hidden factory" costs associated with inconsistency and damage.

1.1. The Manual Workflow: A Time-and-Motion Study

To accurately assess the full cost of manual packaging, one must first map its workflow in detail, which forms the basis for subsequent time, labor, and risk analysis.

1.1.1. Detailed Process Breakdown

Manual coil packaging is a multi-step, labor-intensive process heavily reliant on operator strength and judgment. A typical sequence includes 3:

- Coil Handling: A coil car transports a slit coil from the slitter line to a turnstile in the packaging area.4

- Coil Positioning: An operator uses a downender or upender to orient the coil from an "eye-to-the-sky" (horizontal core) to an "eye-to-the-wall" (vertical core) position for packaging.4 This is a critical handling step requiring precise control to prevent edge damage.

- Palletizing: For multiple smaller coils destined for a single pallet, an operator often uses a jib crane with a coil ID lifter to manually place individual coils onto a wooden pallet.4 This process is slow and highly dependent on operator skill and attention.

- Protective Material Application: Before strapping, operators manually wrap protective materials such as VCI paper, PE film, or cardboard edge protectors to shield the coil’s surfaces and edges from physical damage and corrosion.3

- Manual Strapping: This is the core step for securing the coil for transit. Using manual or pneumatic tools, an operator threads steel or plastic strapping through the coil eye, tensions it, seals it with a crimp, and cuts the strap. This is repeated multiple times for radial and circumferential security.

- Finished Goods Handling: Once packaged, a forklift or crane moves the finished pallet or large individual coil to a storage or shipping area.4

The entire process is replete with repetitive lifting, bending, twisting, and pulling, which is not only inefficient but also sets the stage for the risks and costs analyzed below.

1.1.2. Tools and Equipment

The tooling for a manual line is relatively inexpensive upfront but represents a collection of disparate, non-integrated tools. Key items include:

- Manual Strapping Tools: The most basic setup includes a manual tensioner, a sealer/crimper, and a cutter. Such kits typically cost between $100 and $500 and are suitable for low-frequency tasks.5

- Pneumatic Strapping Tools: To improve efficiency and tensioning force, many operations use pneumatic tools like the Fromm A480.6 These provide stronger tensioning and reduce some operator fatigue. Their cost is significantly higher, often ranging from $3,000 to $3,700.6 Despite the improvement, they still require manual positioning and operation.

- Material Handling Equipment (MHE): This includes forklifts, jib cranes, and coil cars used to move the coils. While these are general plant capital, their frequent use in the packaging area contributes to its operational cost and introduces associated safety risks.

1.1.3. Time and Motion Analysis

The efficiency bottleneck of manual packaging is clear. Studies show that applying a single strap with manual tools—including threading, tensioning, sealing, and cutting—takes 2 to 3 minutes.7 A coil often requires multiple radial and circumferential straps, meaning significant time is spent on strapping alone.

In comparison, even a powered hand tool can only reduce the time per strap to around 30 seconds.7 However, the overall process remains slow as the operator must constantly move and position tools and materials. In a typical low-volume line, throughput is limited by the pace of a single operator or small team, often handling one coil at a time, making packaging a significant bottleneck in the overall production flow.1

1.2. Direct Operational Costs: Labor, Consumables, and Equipment

The direct operational expenditures (OpEx) of manual packaging are the most significant and perpetually growing component of its total cost of ownership.

1.2.1. Labor Costs

Labor is the largest and most volatile expense in manual packaging. A typical manual line requires a team of 4 to 8 operators depending on the production scale.1 These operators handle all tasks, including transport, wrapping, strapping, and documentation.

According to the U.S. Bureau of Labor Statistics (BLS) for May 2023, the median hourly wage for packaging and filling machine operators is approximately $19.81.8 The fully loaded cost, including benefits, insurance, overtime, and administrative overhead, is substantially higher. For a four-person team working 2,080 hours per year, the direct wage cost alone exceeds $160,000. This large, recurring expense is the primary financial driver for companies to seek automation.9

1.2.2. Consumable Costs (Material Usage)

Waste in consumable usage is significant in manual operations and directly erodes profits.

- Strapping: Lacking precise tension control, operators rely on subjective judgment, leading to over- or under-strapping. Over-strapping is a direct waste of material. For a common 3/4" x.020" steel strap, the cost is approximately $0.11 per foot.10 In a high-volume facility, even a few extra feet of strap per coil accumulates into a substantial waste figure annually.

- Stretch Film: This is another prime example of inefficiency. When applying stretch film by hand, operators can achieve a maximum pre-stretch of only 10% to 15%. In contrast, the power pre-stretch units on automated machines easily achieve 250% or more.11 This means that to achieve the same load containment force, manual wrapping can consume more than twice the amount of film. A case of four 18" x 1500′ 80-gauge industrial stretch film rolls costs approximately $64 (or $16 per roll).12 This vast difference in material utilization represents a major, ongoing "hidden" cost of manual packaging.

1.2.3. Equipment and Maintenance

While the purchase cost of individual manual tools is low, the cumulative cost of maintaining, repairing, and replacing a fleet of manual tools, pneumatic tools, forklifts, and cranes is not negligible. Tool wear, damage, and loss are common, and the fuel, power, and regular servicing of MHE like forklifts contribute to the OpEx.

1.3. The Hidden Costs: Inefficiency, Inconsistency, and Product Damage

Beyond direct operational outlays, the manual packaging paradigm generates a series of destructive "hidden" costs that are often difficult to track in traditional financial statements but are lethal to profitability.

1.3.1. The Financial Impact of a Single Damaged Coil

This is one of the most severe potential costs of manual packaging. Improper packaging, such as failing to create an effective moisture barrier, is a primary cause of rust on steel coils during transit and storage.13 Research indicates that improper packaging can increase the risk of product damage by 40%.14

The financial consequence of a single damage event is severe. According to insurance industry data, the average cost of a single steel cargo claim is approximately $17,000.15 This means the direct loss from one coil damaged due to improper packaging can completely negate the labor cost of a packaging team for weeks or even months. This high-cost, episodic risk is the largest financial landmine of the manual packaging model.

1.3.2. Rework and Scrap Costs

A damaged coil must be dealt with, which typically means one of two options: costly rework or disposal as scrap at a fraction of its value.16 In related industries, rework costs can be as high as 12% of the total project cost.17 These costs include not only the materials to repair or re-process the product but also the additional labor, machine time, and management attention required.18 This process effectively creates a "hidden factory" whose only output is fixing the problems created by the deficiencies of the initial process—in this case, manual packaging.

1.3.3. Reputational Damage and Customer Dissatisfaction

Delivering coils with broken packaging, rust, or dented edges leads directly to customer complaints, returns, and the potential loss of future business. This intangible reputational damage, while difficult to quantify, poses a serious threat to the long-term health of the enterprise.19

1.4. The Human Cost: Workplace Safety, Injury Rates, and Insurance Premiums

The persistent physical toll on operators is the most profound cost and risk of the manual packaging model.

1.4.1. Ergonomic Risks and Injury Statistics

Manual material handling is the leading cause of workplace injuries in industrial settings.20 Workers in the steel industry suffer from a higher incidence of musculoskeletal disorders (MSDs) than other sectors due to repetitive lifting, awkward postures, and high force exertions.21 The most common injury types are sprains, strains, and tears, particularly affecting the back and shoulders.20

The hazardous nature of this work is not incidental; it is systemic. Every step of the manual packaging process—from stacking multi-ton coils with a crane to bending over to apply a pneumatic strapping tool—inflicts cumulative damage on the operator’s body.

1.4.2. Workers’ Compensation and Insurance Costs

Workplace injuries translate directly into high financial costs. Data shows the average cost of a single workplace injury is as high as $39,00022, with direct medical costs for a back injury ranging from $3,000 to $10,00011. These claim events directly increase a company’s Experience Modification Rate (EMR), a key factor in calculating workers’ compensation insurance premiums. A higher EMR means the company pays more in premiums for every employee.23

The Workers’ Compensation Board (WCB) sets premiums for manufacturers as a percentage of payroll, with rates ranging from $0.80 to $10.65 per $100 of payroll.23 A manual packaging line, with its large number of physical laborers, therefore has a much higher base insurance cost than a highly automated line. This creates a vicious cycle: high-risk manual work leads to high injury rates, which drive up insurance premiums, further inflating the already high cost of labor. This fundamental flaw in the cost structure is a key reason why the manual model is financially unsustainable.

1.4.3. Lost Productivity

An injured worker means lost workdays. In the U.S., 104 million workdays are lost annually due to work-related injuries.22 This not only requires the company to pay for sick leave but often necessitates hiring temporary workers and leads to disruptions in production flow and a decrease in overall productivity.

In summary, the true cost of manual steel coil packaging extends far beyond tools and wages. It is a complex system of high direct operational costs, massive product damage risks, and heavy financial liabilities related to human safety. This model exposes a company’s profitability and operational stability to constant, unpredictable risk.

Section 2: The Automated Coil Packaging Line: A System and Capability Overview

In stark contrast to the high-risk, high-variable-cost model of manual packaging stands the fully automated line. This section details this alternative paradigm, focusing on its system composition, its revolutionary impact on productivity and quality, and its role as a future-ready, data-centric strategic asset.

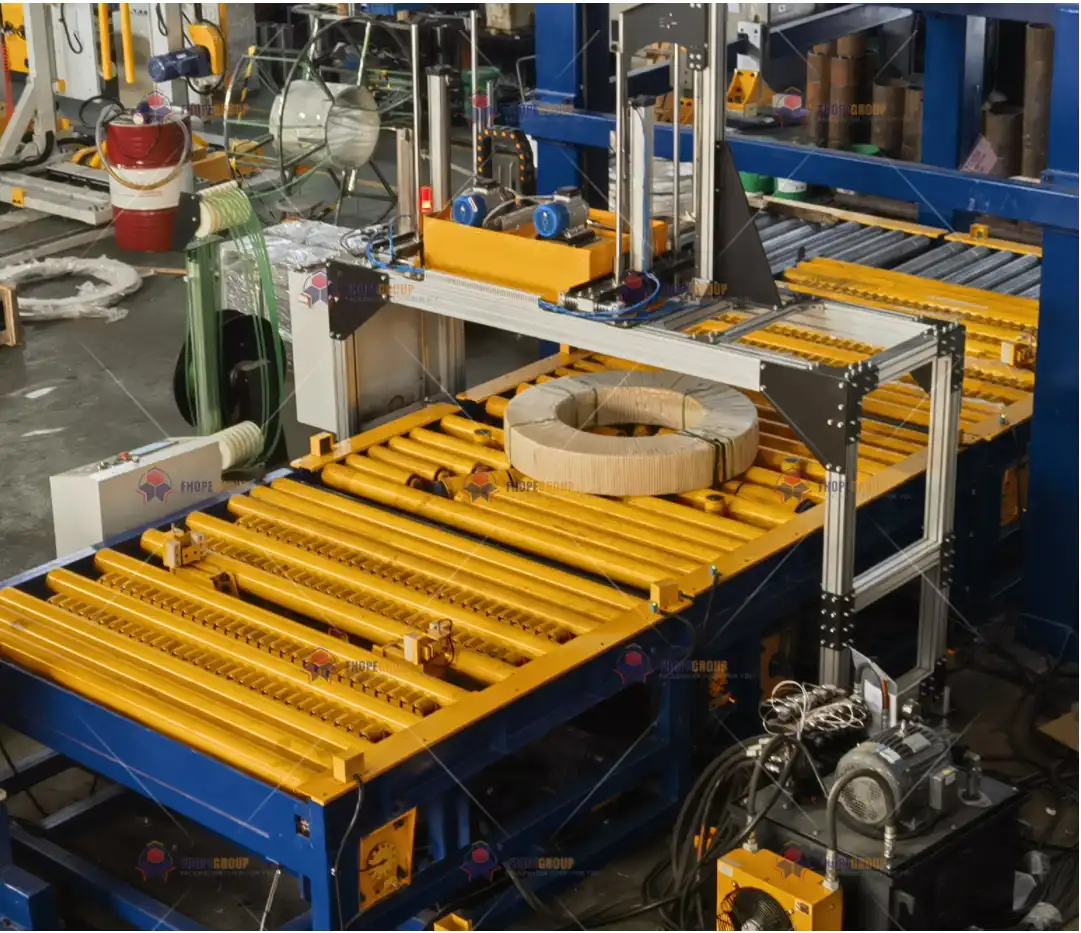

2.1. Anatomy of an Automated Line: Core Components and Modular Integration

A modern, fully automated coil packaging line is a highly integrated, seamlessly orchestrated system designed to take a coil from slitting to shipment-ready with minimal human intervention.

2.1.1. System Workflow

A typical automated workflow proceeds as follows 3:

- Automated Infeed: A coil car automatically receives a coil from the slitter’s turnstile and transports it to the packaging line’s entry point.

- Automatic Positioning and Tilting: The coil is conveyed to a downender, which automatically tilts it from an eye-to-the-sky to an eye-to-the-wall orientation based on the pre-set program, preparing it for through-eye strapping and wrapping.

- Conveyor System: A system of powered roller or chain conveyors moves the coil precisely and smoothly between processing stations.

- Automatic Through-Eye Strapping: The coil enters an automatic strapping machine. The machine’s track arm passes through the coil’s eye, automatically feeding, tensioning, welding (or sealing), and cutting the strap for multiple radial and circumferential bands.4

- Automatic Orbital Stretch Wrapping: After strapping, the coil is conveyed to an orbital stretch wrapper. A ring-shaped shuttle carrying stretch film orbits around the coil while passing through its eye, applying VCI rust-inhibiting film and stretch film tightly and uniformly over all surfaces for a complete seal.3

- Weighing and Labeling: The packaged coil passes over an integrated weigh station, where its exact weight is recorded, and an automatic label applicator prints and applies a label with all critical information (weight, specs, customer code, barcode).3

- Robotic Palletizing: Finally, the finished coil is conveyed to a palletizing station. A robotic arm or automatic stacker, following a pre-set program, precisely stacks the coils onto a pallet, often with automatic placement of wooden spacer blocks, creating a stable, neat stack ready for a forklift or AGV.4

2.1.2. Core Machinery Deep Dive

- Handling Equipment: Automated coil cars, multi-station turnstiles, and "pick-and-place" downenders are foundational for efficient, damage-free handling. Controlled by PLCs and sensors, they operate in precise synchronization, drastically reducing the edge damage common with traditional crane and forklift operations.4

- Strapping Equipment: The fully automatic through-eye strapper is key to efficiency and consistency. Whether using steel or PET strapping, the machine ensures that the tension on every strap is precise and uniform, a feat impossible to achieve manually.

- Wrapping Equipment: The orbital stretch wrapper is the core of high-quality packaging. Its key technology is the power pre-stretch system, which stretches the film by over 250% before it leaves the film carriage. This means 1 meter of film can be stretched to cover 3.5 meters, which not only provides massive material savings but also results in a film with greater memory and containment force for superior load security.24 The Through-Eye Wrapping (TEW) technique creates a hermetically sealed package, locking out moisture and preventing the evaporation of VCI rust inhibitors, which fundamentally solves the problem of corrosion.1

- Stacking and Palletizing Equipment: Automatic spacer placers and robotic palletizers ensure the final stack is stable and safe. Robots can tirelessly and precisely execute stacking patterns, creating dense, regular stacks that optimize warehouse space and facilitate transport.4

2.1.3. Modularity and Scalability

A key feature of modern automated packaging lines is their modular design.1 This means the entire line is composed of standardized functional modules (e.g., strapping module, wrapping module, conveyor module). This design philosophy offers companies tremendous flexibility, allowing them to selectively invest in the most critical automation stages based on current budget and needs, while leaving interfaces for future upgrades and expansion. A company can adopt a phased investment strategy, for example, by first automating wrapping and strapping, and then adding a robotic palletizing system later as production volume increases.25

2.2. A Quantum Leap in Productivity: Throughput and Efficiency Benchmarks

The productivity gains from automation are revolutionary, not incremental.

2.2.1. Throughput Comparison

The difference is an order of magnitude. A manual packaging line, even with 4-8 skilled workers, can only process a few coils per hour. A fully automated line, such as the Pesmel F60, requires only 1-2 supervisors and can achieve a throughput of 20 to 30 coils per hour.1 Semi-automatic stretch wrappers can handle up to 35 pallets per hour, while fully automatic models can process between 30 and 200 pallets per hour.26 This massive leap in capacity means packaging is no longer a production bottleneck, and the company can handle peak order volumes and take on larger-scale business.

2.2.2. Labor Reduction and Redeployment

One of the most direct financial benefits of automation is the drastic reduction in reliance on direct labor. Reducing the number of operators from eight to one or two not only cuts enormous wage and benefit expenses but, more importantly, frees human resources from low-value, repetitive physical tasks. These experienced employees can be redeployed to more valuable roles such as quality monitoring, equipment maintenance, and process optimization, creating greater value for the company.27

2.2.3. Downtime Reduction

In manufacturing, unplanned downtime is a massive cost drain, averaging $260,000 per hour.28 Manual operations suffer from frequent and unpredictable downtime due to operator fatigue, errors, and tool failures. A well-designed and maintained automated line is known for its high reliability, with uptime easily exceeding 98%.29 Through preventative maintenance and real-time monitoring, unexpected stops can be minimized, ensuring production continuity and stability.

2.3. Precision and Quality Control: Mitigating Damage and Optimizing Materials

Automation replaces human variability with machine precision, leading to breakthroughs in quality control and cost savings.

2.3.1. Damage Mitigation

Automated handling systems, with their smooth acceleration and deceleration and precise positioning, provide "gentle" handling of coils, reducing physical damage from collisions and drops from the outset.30 More importantly, as previously noted, the airtight TEW wrapping technology provides the ultimate protection against moisture and rust, directly addressing the primary quality issue that leads to high-cost claims.1

2.3.2. Material Savings

This is another major driver of ROI for automation.

- Strapping: Automated systems apply precise, pre-programmed tension and use the most efficient strapping patterns, eliminating the waste seen in manual operations.31

- Wrapping Film: Power pre-stretch technology is key. By increasing the utilization of stretch film several-fold, automated systems can achieve a 50% to 66% reduction in film usage.11 Research from Pesmel shows that by optimizing the cutting and application of materials, an automated packaging line can reduce total packaging material costs by 30%.1

2.3.3. Energy Consumption

Modern automated lines are designed with energy efficiency in mind. A typical orbital wrapper’s drive motors and control system have a total power consumption of only 1-3 kW.32 Compared to the irregular and difficult-to-track energy consumption of forklifts and cranes in a manual setup, the energy cost of an automated line is predictable and relatively low.33

2.4. The Future-Ready Factory: Scalability, Data Integration (MES/ERP), and Maintenance

Investing in an automated packaging line is not just about buying a set of machines; it is about laying the foundation for the factory’s digital and intelligent future.

2.4.1. System Integration

A fully automated line is designed from the ground up for integration with higher-level information systems. Using standard industrial Ethernet protocols, the packaging line can seamlessly connect to the plant’s Manufacturing Execution System (MES) or Enterprise Resource Planning (ERP) system.34 This breaks down the final information silo between order placement and finished goods inventory.

2.4.2. Data and Traceability

A manual packaging line is a "data black hole," whereas an automated line is a rich source of data. Its integrated PLCs, sensors, weighing modules, and labeling systems can capture and record precise data for every coil in real-time: weight, dimensions, packaging time, material lots used, operator ID, and more.34 When this data is uploaded to the MES/ERP system, it provides managers with unprecedented operational insight. It supports accurate cost accounting, optimized inventory management, and provides customers with complete product traceability, which is critical for quality issue resolution and meeting the requirements of high-end clients.

2.4.3. Maintenance and Lifecycle

Modern lines incorporate the concept of predictive maintenance. By monitoring the vibration, temperature, and operational status of key components (like motors, bearings, and cylinders) with sensors, the system can predict potential failures before they occur and proactively schedule maintenance, thus avoiding costly unplanned downtime.35 While an automated system requires professional maintenance, its costs are predictable and far lower than the massive production losses caused by a sudden equipment breakdown.

From a strategic perspective, investing in an automated packaging line means replacing uncontrollable, escalating operational risks and variable costs with a controllable, depreciable capital expenditure. It not only solves immediate efficiency and cost problems but, more importantly, builds a more resilient and competitive operational foundation for the enterprise by introducing stability, predictability, and data.9

Section 3: Comprehensive Financial Comparison: Manual vs. Automated Systems

This section serves as the analytical core of the report, consolidating the qualitative descriptions and disparate data from the previous sections into a direct, quantitative financial model. Through a side-by-side comparison, this section will clearly reveal the true lifecycle cost disparity between the manual and automated paradigms.

3.1. Capital Expenditure (CapEx) Analysis: Automation Investment and Retrofitting

Capital expenditure is the most striking difference between the two models, but its composition and strategic options are far more complex than the surface numbers suggest.

3.1.1. CapEx of a Manual Line

The initial investment threshold for a manual line is extremely low, which is its most deceptive "advantage." Its CapEx primarily consists of:

- Hand Tools: A basic set of a manual tensioner, sealer, and cutter costs only a few hundred dollars.5

- Pneumatic Tools: Higher-performance pneumatic tools, like the Fromm A480, are priced between $3,000 and $3,700 each.6 A packing station may require multiple sets.

- Material Handling Equipment: Forklifts and jib cranes. These are often considered general plant equipment, and their costs are amortized, so the dedicated CapEx for the packaging area is very limited.

Overall, the direct capital outlay to establish a manual packing station is minimal, leading many companies to initially opt for this seemingly "economical" solution.

3.1.2. CapEx of an Automated Line

The initial investment for an automated line is substantial, but its value lies in creating a complete, integrated system. The cost varies based on the level of automation, brand, and customization, but can be broken down into key modules:

- Semi-Automatic Equipment: This is the entry-level for automation. For example, a semi-automatic strapping machine starts at around $2,500.36

- Fully Automatic Standalone Machines:

- Automatic Strapping Machine (with arch): Starts at approximately $6,500.36

- Orbital Stretch Wrapper: Entry-level semi-automatic models range from $20,000 to $30,000, while fully automatic models with remote control and auto film cut-and-clamp features are priced from $25,000 to over $50,000.37

- Robotic Palletizer: This is the most advanced module with the highest cost. Entry-level collaborative robot palletizing systems start at around $100,000.38

- Fully Integrated Line: Integrating the above modules with conveyors, downenders, weigh-labeling systems, etc., creates a complete packaging line. The total investment typically ranges from $150,000 to over $500,000, depending on complexity and capacity requirements.25 A comprehensive project including installation, commissioning, and training could have a total investment cost modeled between $330,000 and $680,000.9

3.1.3. Retrofitting and Phased Investment

For many companies, a one-time investment of hundreds of thousands of dollars may be challenging. Therefore, retrofitting an existing line or adopting a phased investment strategy becomes a highly attractive approach.2 This allows businesses to achieve automation gradually with a lower initial cost.

- Cost-Effectiveness: The cost of a retrofit is much lower than purchasing entirely new equipment. For example, upgrading just the control system (e.g., HMI) can be highly cost-effective with a short installation period of one to two weeks.39

- Phased Path: A company can first invest in addressing its biggest pain point, for instance, by introducing a semi-automatic wrapper to solve the film waste problem.24 The ROI from this first step can then help fund the next phase of investment, such as adding an automatic strapping machine. This incremental path lowers investment risk and makes automation accessible to a broader range of enterprises.2

The following table outlines the capital expenditure for different automation strategies:

Table 1: Automation Capital Expenditure (CapEx) Scenarios

| Component | Manual / Basic Cost | Semi-Auto / Phased Cost | Fully Automated Line Cost |

|---|---|---|---|

| Strapping Machine | $300 – $3,500 | $2,500 – $7,000 | $16,000+ |

| Wrapping Machine | (Manual Wrapping) | $20,000 – $35,000 | $35,000 – $70,000+ |

| Conveyors & Handling | (Forklift/Crane) | (Partial Conveyors) | $30,000 – $100,000+ |

| Palletizer | (Manual Palletizing) | (Manual Palletizing) | $100,000+ |

| Installation & Training | N/A | $10,000 – $30,000 | $50,000 – $100,000 |

| Total Estimated Cost | < $10,000 | $50,000 – $150,000 | $200,000 – $500,000+ |

Note: All prices are estimated ranges based on research data. Actual costs will vary depending on the vendor, specifications, and level of customization.

3.2. Operational Expenditure (OpEx) Modeling: A Comparative Analysis

If CapEx is one side of the scale, OpEx is the other, and its weight grows continuously over time. Automation fundamentally changes the structure of OpEx.

Table 2: Annual Operational Expenditure (OpEx) Comparative Model

| Cost Category | Manual Packaging Line (Est.) | Automated Packaging Line (Est.) | Annual Savings | Notes / Basis for Calculation |

|---|---|---|---|---|

| Labor Costs | $250,000 | $65,000 | $185,000 | Based on 4 operators vs. 1 supervisor at $25/hr fully loaded 1 |

| Consumable Costs | ||||

| – Strapping | $50,000 | $40,000 | $10,000 | Assumes 20% waste rate eliminated by precise control |

| – Stretch Film | $60,000 | $24,000 | $36,000 | Based on 60% material savings from pre-stretch technology 11 |

| Maintenance Costs | $15,000 | $25,000 | -$10,000 | Higher service contract cost for automation, offset by reduced downtime |

| Energy Costs | $10,000 | $8,000 | $2,000 | Based on forklift/crane vs. energy-efficient motors 33 |

| Cost of Poor Quality | $85,000 | $8,500 | $76,500 | Based on 0.5% vs. 0.05% damage rate and $17,000/incident cost 15 |

| Workers’ Comp Insurance | $20,000 | $2,000 | $18,000 | Based on premiums tied to payroll and risk classification 23 |

| Total Annual OpEx | $490,000 | $172,500 | $317,500 |

This model clearly illustrates the "OpEx inversion" effect. In the manual model, over 75% of OpEx consists of variable costs like labor and waste. In the automated model, these variable costs are drastically cut, making the total operational cost significantly lower and more stable and predictable.

3.3. Quantifying the Intangibles: The Financial Impact of Downtime, Rework, and Safety

In addition to regular OpEx, manual operations introduce enormous, unpredictable financial risks. Quantifying these risks is essential to understanding the full value of automation.

Table 3: Financial Impact of Hidden Costs (Annual Estimate)

| Risk Category | Manual Packaging Line | Automated Packaging Line | Annual Savings | Notes / Basis for Calculation |

|---|---|---|---|---|

| Unplanned Downtime Cost | 40 hours/year | 8 hours/year | $8,320,000 | Assumes 2% vs. 0.4% downtime rate at $260,000/hour 40 |

| Rework/Scrap Cost | $85,000 | $8,500 | $76,500 | Same as Cost of Poor Quality in Table 2 |

| Workplace Injury Cost | $39,000 | $3,900 | $35,100 | Assumes 1 vs. 0.1 incidents/year at an average cost of $39,000 22 |

| Total Hidden Costs | $8,444,000 | $20,400 | $8,423,600 |

The conclusion from this table is staggering. It reveals the greatest weakness of the manual packaging model: risk exposure. The savings from avoiding just a few dozen hours of unplanned downtime per year are enough to cover the entire investment in an automated line multiple times over. This provides powerful evidence that automation is not just an efficiency tool but a potent risk management and operational stability strategy. Including these "hidden," catastrophic costs makes the financial case for investing in automation irrefutable.

Section 4: The Strategic Financial Case: ROI and Payback Period Analysis

This section synthesizes all preceding financial data to construct the final business case, articulating the strategic value of an automation investment through clear, compelling Return on Investment (ROI) and Payback Period metrics.

4.1. Building the ROI Model: A Detailed Walkthrough of Inputs and Calculations

To evaluate the financial feasibility of an automation investment, we use two core metrics: Return on Investment (ROI) and Payback Period.

-

Return on Investment (ROI) Formula:

ROI (%) = (Annual Net Gain / Total Initial Investment) * 100 -

Payback Period Formula:

Payback Period (Years) = Total Initial Investment / Annual Net Gain

Here, "Annual Net Gain" is the sum of all annual savings and increased revenue from automation, and "Total Initial Investment" is the capital expenditure analyzed in Section 3.

4.1.1. Detailed Calculation Walkthrough

We will perform a specific calculation based on the financial models from the previous sections.

- Total Initial Investment: We will take the midpoint of the cost range for a fully automated line from Table 1 and combine it with the comprehensive models in 9, setting a realistic investment figure of $505,000.

- Annual Net Gain: This gain consists of two parts:

- Operational Cost Savings: From the calculations in Table 2, the annual OpEx savings are $317,500.

- Revenue from Increased Productivity: This includes additional revenue from reduced downtime and increased throughput. According to Table 3, reducing downtime alone can yield massive financial benefits. To be conservative, we will assume that increased efficiency and reduced bottlenecks lead to a 10% increase in annual production. If this extra 10% of output (assuming 5,000 coils) generates a marginal profit of $50 per coil, the annual revenue increase is $250,000.

- Total Annual Net Gain = $317,500 (OpEx Savings) + $250,000 (Increased Revenue) = $567,500.

Now, we can calculate the ROI and Payback Period:

- ROI Calculation:

ROI = ($567,500 / $505,000) * 100 ≈ 112.4% - Payback Period Calculation:

Payback Period = $505,000 / $567,500 ≈ 0.89 years

This result means the investment can be fully recouped in less than one year (approximately 10.7 months), and thereafter will generate over $560,000 in net profit annually. This highly attractive financial performance aligns with the 1- to 2-year payback periods mentioned in multiple case studies 37, providing strong evidence for the financial justification of an automation investment.

4.1.2. The Relationship Between ROI and Production Scale

It is important to note that the return on investment is closely tied to production scale. The fixed cost of an automated line is amortized over every coil packaged, while the variable cost savings per coil (primarily labor and consumables) are constant. Therefore, the higher the production volume, the lower the amortized fixed cost per coil and the higher the total savings. This means that for high-volume businesses or those with growth plans, the financial appeal of an automation investment grows exponentially. A "break-even" production volume can be defined, beyond which investing in automation becomes a financial necessity.

4.2. Scenario Analysis: Payback Periods for Phased vs. Full Automation Implementation

For businesses with different capital budgets and risk appetites, analyzing various investment paths is crucial.

Table 4: ROI and Payback Period Projections for Different Automation Strategies

| Investment Scenario | Total Initial Investment (Est.) | Annual Net Gain (Est.) | ROI (%) | Payback Period (Years) | Key Advantage |

|---|---|---|---|---|---|

| Manual (Baseline) | < $10,000 | $0 | N/A | N/A | Extremely low initial cost |

| Phase 1: Crawl (Semi-Auto Wrapper) | $30,000 | $40,000 | 133% | 0.75 | Quickly solves material waste, fast ROI |

| Phase 2: Walk (+ Auto Strapper) | $60,000 (Cumulative) | $120,000 | 200% | 0.5 | Drastically cuts labor, improves consistency |

| Full Automation | $505,000 | $567,500 | 112% | 0.89 | Maximizes throughput, data integration, best long-term cost |

This table clearly illustrates the financial consequences of different strategic choices.

- Full "Lights-Out" Automation: While requiring the highest initial investment, it also yields the largest annual net gain, providing the highest long-term value and maximum capacity.

- Phased Automation ("Crawl-Walk-Run"): This strategy presents a pragmatic path.2

- Crawl: First, invest in a semi-automatic orbital stretch wrapper. This addresses one of the biggest pain points—material waste and load security—with a relatively low capital outlay (approx. $20-30k 37) and an extremely short payback period (less than 1 year).

- Walk: Use the savings from the first phase to invest in an automatic strapping machine to address the largest labor costs and inconsistent strapping.

- Run: Finally, achieve complete end-to-end automation by integrating a conveyor system and robotic palletizer, maximizing efficiency and data collection capabilities.

This phased approach makes the automation project more financially manageable, lowers risk, and allows the company to use the success of one phase to build support and confidence for subsequent investments.2

4.3. The Long-Term Value Proposition: Beyond Initial Returns

The true value of automation extends beyond simple financial returns; it builds long-term strategic advantages for the business.

4.3.1. Competitive Advantage

Automation provides the ability to scale. In a manual model, capacity growth is almost linearly tied to increases in labor. Automation breaks this constraint, allowing a company to significantly increase output to meet market demand fluctuations without proportionally increasing its workforce.41 This elasticity is a massive competitive advantage that the manual model cannot match.

4.3.2. Enhanced Customer Relationships

Consistently delivering perfectly packaged, undamaged products with accurate traceability data greatly enhances customer trust and satisfaction. This not only reduces the administrative costs of handling claims and returns but, more importantly, solidifies customer relationships, improves brand reputation, and leads to more repeat business.14

4.3.3. Automation as a Hedge Against Inflation

The primary cost of a manual line is labor, which is an inevitably rising and unpredictable variable subject to inflation, minimum wage increases, and rising benefit costs.11 In contrast, the primary cost of an automated line is the upfront capital investment, which is a fixed, one-time expense. Its subsequent operating costs (like energy and spare parts), while also subject to inflation, represent a smaller portion of the total cost of ownership. Therefore, investing in automation effectively "locks in" the majority of future packaging costs at today’s prices. This is a powerful strategic hedge against future labor cost inflation, providing the business with long-term financial stability and predictability.

4.3.4. Laying the Foundation for Industry 4.0

An integrated, data-driven automated packaging line is a necessary prerequisite for realizing the vision of a "lights-out" or "smart" factory. It not only provides the physical automation but, more importantly, generates the data stream required to drive higher-level information systems (MES/ERP), making it a critical node in building a complete Industry 4.0 ecosystem.34

In conclusion, the financial case for investing in an automated steel coil packaging line is comprehensive and overwhelming. It not only delivers a rapid return in the short term through operational efficiency and cost reduction but, more importantly, creates immeasurable long-term strategic value by mitigating risk, enhancing customer relationships, hedging against inflation, and building future capabilities.

Section 5: Recommendations and Implementation Roadmap

Based on the exhaustive analysis presented, this section aims to provide clear, actionable guidance to help companies transition smoothly from strategic decision-making to successful implementation.

5.1. Strategic Recommendation: Justifying the Transition to Automation

The final recommendation of this report is to resolutely and strategically advance the automation of the packaging process. This recommendation is not based solely on cost-cutting considerations but views automation as a strategic imperative to ensure the company remains a leader in efficiency, safety, quality, and long-term competitiveness. The data clearly shows that for any operation handling more than a basic threshold (e.g., 15-20 coils per day 24), the financial case for investing in at least semi-automated packaging is extremely compelling. Continuing to rely on fully manual packaging is tantamount to exposing the company’s profits and reputation to unacceptably high levels of risk and inefficiency.

5.2. The Phased Implementation Strategy: Maximizing ROI and Minimizing Disruption

To make this strategic transition both financially and operationally feasible, a "Crawl-Walk-Run" phased implementation approach is recommended. This method breaks down the large automation project into a series of manageable, financially self-sustaining steps, thereby maximizing return on investment and minimizing disruption to existing production.2

5.2.1. Phase 1: Crawl – Address the Biggest Pain Point for a Quick Win

- Objective: Solve the problems of material waste and load security. This is one of the easiest to quantify and most significant costs in manual packaging.

- Action: Invest in a semi-automatic orbital stretch wrapper. This device, with its power pre-stretch capability, will immediately reduce stretch film consumption by over 50% while providing superior and more consistent load containment.

- ROI: This phase involves a relatively low investment (approx. $20-30k 37) but delivers immediate and significant savings in materials and quality improvements, with a payback period typically under one year.

5.2.2. Phase 2: Walk – Address Core Labor Costs

- Objective: Cut the largest variable cost—direct labor—and improve packaging consistency.

- Action: Add a fully automatic through-eye strapping machine to the existing line. This will replace the most time-consuming and physically demanding manual strapping tasks, freeing operators from repetitive labor.

- ROI: The investment in this phase (approx. $20-50k) will be recouped through significant labor cost savings. At the same time, the machine’s precise tension control further enhances packaging quality.

5.2.3. Phase 3: Run – Achieve Full Automation and Data Integration

- Objective: Build a seamless, efficient, data-driven end-of-line (EOL) packaging system.

- Action: Integrate an automated conveyor system, a robotic palletizing system, and connect the entire line to the plant’s MES/ERP system.34 This will achieve full automation from coil exit to finished goods inventory, with no manual intervention required.

- ROI: This is the highest investment phase, but it delivers the maximum benefits: throughput reaches its peak, labor costs are minimized (requiring only supervisory personnel), and complete quality traceability and data collection are achieved, laying the final foundation for a "lights-out" factory.

The advantage of this roadmap lies in its flexibility and pragmatism. A company can pause at any stage, evaluate the benefits, and then decide if and when to proceed to the next phase.

5.3. Key Criteria for Vendor and Technology Selection

The key to a successful automation implementation lies not just in the technology itself, but in choosing the right partners and solutions.

5.3.1. Vendor as Partner

When selecting a vendor, think beyond a simple equipment purchase. It is crucial to find an integration partner who can provide a full range of services, from system design, engineering, installation, and commissioning to operator training and long-term after-sales support.27 A good vendor will deeply understand your specific needs and provide a tailor-made solution.

5.3.2. Technology Considerations

- Modularity and Scalability: Ensure the chosen technology platform is modular and supports future upgrades and expansion. This is closely linked to the phased implementation strategy and ensures that today’s investment will not become obsolete tomorrow.1

- System Integration Capability: The selected equipment must be able to easily integrate with your existing or future MES/ERP systems. Check if it supports standard industrial communication protocols (e.g., OPC-UA, Profinet), which is key to achieving data-driven manufacturing.34

- Total Cost of Ownership (TCO) Analysis: The final decision should be based on a comprehensive Total Cost of Ownership analysis, not just the lowest initial purchase price.42 TCO should include the equipment price, installation and commissioning, training, annual maintenance contracts, spare parts inventory, and expected energy consumption. A system with a lower initial price but high maintenance costs, expensive spare parts, and frequent downtime may have a much higher long-term cost than a more reliable and durable system with a higher initial investment.

By following this strategic framework and implementation roadmap, companies can confidently embark on their packaging automation transformation journey, turning this function from a cost center into a strategic asset that creates value and competitive advantage.

Works cited

-

PESMEL COIL PACKING, accessed June 20, 2025, https://pesmel.com/wp-content/uploads/2020/05/Pesmel_Metal_Coil_Packing_lowres-1.pdf ↩ ↩ ↩ ↩ ↩ ↩ ↩ ↩ ↩ ↩ ↩

-

Maximizing profit margins: The strategic shift to end-of-line packaging automation, accessed June 20, 2025, https://www.packagingdive.com/spons/maximizing-profit-margins-the-strategic-shift-to-end-of-line-packaging-aut/738725/ ↩ ↩ ↩ ↩ ↩ ↩

-

Why a Steel Coil Packing Line is Essential for Growth – wrapping machine manufacturer, accessed June 20, 2025, https://www.shjlpack.com/info/why-a-steel-coil-packing-line-is-essential-for-growth/ ↩ ↩ ↩ ↩ ↩

-

SLIT COIL PACKAGING – Arcon, accessed June 20, 2025, https://www.arcon-metals.sk/MediaLibrary/arcon-metals/arcon-metals/Pdf/pdf30.pdf ↩ ↩ ↩ ↩ ↩ ↩ ↩ ↩

-

VEVOR Steel Strapping Tool for 1/2 in.-3/4 in. Width 3-in-1 (Tensioner, Crimper, Cutter) Manual Belt Packaging Banding Machine SDGDKZGJDJT04MNNHV0 – The Home Depot, accessed June 20, 2025, https://www.homedepot.com/p/Steel-Strapping-Tool-for-1-2-in-3-4-in-Width-3-in-1-Tensioner-Crimper-Cutter-Manual-Belt-Packaging-Banding-Machine-SDGDKZGJDJT04MNNHV0/329729343 ↩ ↩

-

A480 Pneumatic Steel Strapping Tool | Free Shipping | Direct Pricing, accessed June 20, 2025, https://frommstrappingsystems.com/shop/strapping-tool/a480/ ↩ ↩ ↩

-

Poly & Steel Strapping Guide – Packaging Equipment Automation and Damage Prevention, accessed June 20, 2025, https://info.ipack.com/guide/definitive-strapping-guide ↩ ↩

-

Packaging and Filling Machine Operators and Tenders – Bureau of Labor Statistics, accessed June 20, 2025, https://www.bls.gov/oes/2023/may/oes519111.htm ↩

-

ROI Calculation Model for Steel Coil Packing Line Implementation – FhopePack, accessed June 20, 2025, https://www.fhopepack.com/zh/roi-calculation-model-for-steel-coil-packing-line-implementation/ ↩ ↩ ↩ ↩

-

3/4" x .020" Regular Duty Steel Strapping – Complete Packaging Products, accessed June 20, 2025, https://www.completepackagingproducts.com/3-4-x-020-Regular-Duty-Steel-Strapping-p/1022.htm ↩

-

The ROI of Packaging Automation, accessed June 20, 2025, https://www.ipack.com/solutions/post/roi-packaging-automation ↩ ↩ ↩ ↩ ↩

-

Stretch Wrap Rolls – Global Industrial, accessed June 20, 2025, https://www.globalindustrial.com/c/packaging/stretch_wrap_shrink_wrap/stretch_wrap ↩

-

TRANSPORT OF COILED MATERIALS IN CONTAINERS – Hapag-Lloyd, accessed June 20, 2025, https://www.hapag-lloyd.com/content/dam/website/downloads/local_info/%E9%92%A2%E5%8D%B7%E6%8D%86%E6%89%8E.pdf ↩

-

Why Steel Coil Packaging Requires Special Considerations? – wrapping machine manufacturer – SHJLPACK, accessed June 20, 2025, https://www.shjlpack.com/info/why-steel-coil-packaging-requires-special-considerations/ ↩ ↩

-

Transport Guidance for Steel Cargoes – The American Club, accessed June 20, 2025, https://www.american-club.com/files/files/steel_cargo_guide.pdf ↩ ↩

-

Steel sheet in coils – Cargo Handbook, accessed June 20, 2025, https://www.cargohandbook.com/Steel_sheet_in_coils ↩

-

The True Cost of Rework in Construction – Visibuild, accessed June 20, 2025, https://visibuild.com/the-true-cost-of-rework-in-construction/ ↩

-

Rework Costs – FasterCapital, accessed June 20, 2025, https://fastercapital.com/keyword/rework-costs.html/1 ↩

-

The hidden costs of shipping damage: Impact and solutions – EP Logistics, accessed June 20, 2025, https://eplogistics.com/blog/shipping-damage/ ↩

-

The 3 most common types of manual handling injuries – TAWI, accessed June 20, 2025, https://www.tawi.com/lifting-insights/the-3-most-common-types-of-manual-handling-injuries ↩ ↩

-

Solutions for the Prevention of Musculoskeletal Injuries in Foundries | OSHA, accessed June 20, 2025, https://www.osha.gov/sites/default/files/publications/osha3465.pdf ↩

-

How Manufacturing Automation Can Reduce Workplace Injuries and Improve Morale, accessed June 20, 2025, https://www.assemblymag.com/ext/resources/White_Papers/2019/sep/UR_Workplace-Injuries-White-Paper-Final_May2019.pdf ↩ ↩ ↩

-

How Robotics and Automation Impact WCB Premiums – Enginuity Inc., accessed June 20, 2025, https://enginuityinc.ca/industry-4-0/automation-impact-wcb-premiums/ ↩ ↩ ↩

-

Hand Wrapping VS Stretch Wrapping – Wulftec International Inc., accessed June 20, 2025, https://www.wulftec.com/sales/hand-wrapping-vs-stretch-wrapping ↩ ↩ ↩

-

Coil packaging lines – Amova, accessed June 20, 2025, https://www.amova.eu/en/steel-industry/products/detail/coil-packaging-lines ↩ ↩

-

Automation vs. Manual Packaging: Which Is Best for You? – Robopac USA, accessed June 20, 2025, https://robopacusa.com/automation-vs-manual-packaging-which-is-best-for-you/ ↩

-

Products / Automatic Packing Line / Coil Packing Line – SHJLPACK, accessed June 20, 2025, https://www.shjlpack.com/products-and-production/coil-packing-line/ ↩ ↩

-

The Cost of Downtime in Manufacturing, accessed June 20, 2025, https://fourjaw.com/blog/the-cost-of-downtime-in-manufacturing ↩

-

When to Upgrade Your Packaging Line: Signs You Need New Equipment, accessed June 20, 2025, https://www.packagingequipmentnews.com/when-to-upgrade-your-packaging-line/ ↩

-

Research on Steel Coil Storage, Logistics, and Packaging Automation – FhopePack, accessed June 20, 2025, https://www.fhopepack.com/zh/research-on-steel-coil-storage-logistics-and-packaging-automation/ ↩

-

How to Choose the Right Strapping System for Your Application – Handle It, accessed June 20, 2025, https://www.handleitinc.com/news/how-to-choose-the-right-strapping-system/ ↩

-

Automatic Coil Stretch Wrapping Machine – Filsilpek Solutions Private Limited, accessed June 20, 2025, https://www.filsilpeksolutions.com/automatic-coil-stretch-wrapping-machine.html ↩

-

Semi Auto Vertical Coil Stretch Wrapping Machine – N.K. Enterprise, accessed June 20, 2025, https://www.nkenterpriseindia.com/our-products/item/15-coil-stretch-wrapping-machine/34-semi-auto-vertical-coil-stretch-wrapping-machine ↩ ↩

-

automatic steel coil packing system manufacturer, accessed June 20, 2025, http://icoiler.com/Automatic-steel-coil-packing-line/index.html ↩ ↩ ↩ ↩ ↩

-

Coil Packaging Line Maintenance Guide (Updated 2025), accessed June 20, 2025, https://www.shjlpacking.com/info/coil-packaging-line-maintenance-guide-updated-102958200.html ↩

-

How Much Does A Strapping Machine Cost? – Industrial Packaging, accessed June 20, 2025, https://www.industrialpackaging.com/blog/strapping-machine-cost ↩ ↩

-

How much does an orbital wrapper cost?, accessed June 20, 2025, https://www.tabwrapper.com/latest-news-blog/how-much-does-an-orbital-wrapper-cost/ ↩ ↩ ↩ ↩

-

Standard & Custom Robotic Palletizers – MMCI Automation, accessed June 20, 2025, https://www.mmci-automation.com/robotic-palletizers.html ↩

-

Packaging System Retrofitting, Rebuilding, or Buying New: A Guide – Premier Tech, accessed June 20, 2025, https://www.ptchronos.com/blog/retrofit-rebuild-buy-new ↩

-

Guide to Reducing Downtime in Manufacturing – Corrugated Metals Inc., accessed June 20, 2025, https://www.corrugated-metals.com/blog/guide-to-reducing-downtime-in-manufacturing/ ↩

-

Manual Packaging vs. Automatic Packaging Machines, accessed June 20, 2025, https://www.gwcnow.com/blog/gwc-blog-1/manual-packaging-vs-automatic-packaging-machines-16 ↩

-

What Is The Way To Know Coil packing line price By Yourself – FhopePack, accessed June 20, 2025, https://www.fhopepack.com/coil-packing-line/Coil-packing-line-price.html ↩